Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

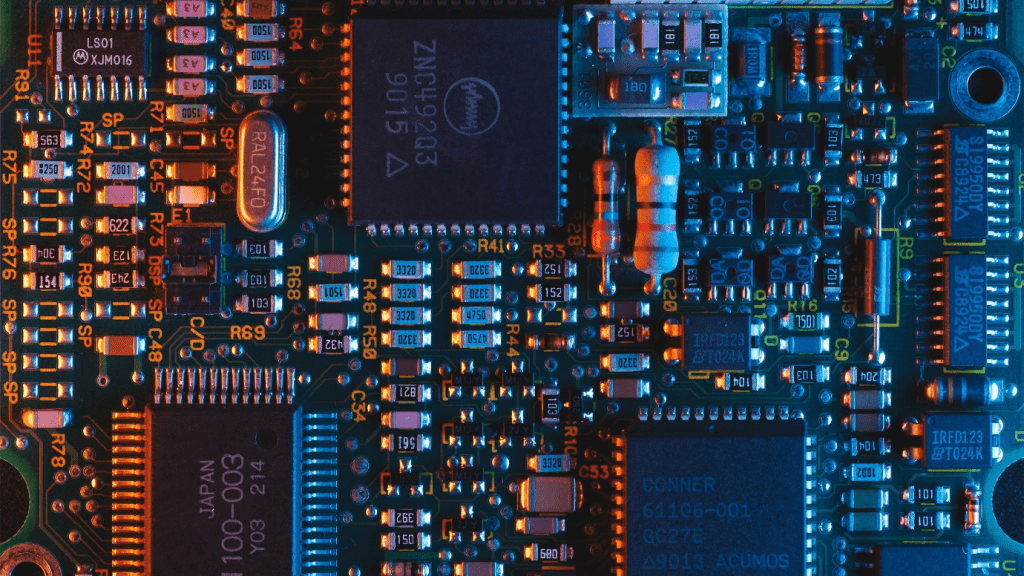

February 15, 2022: -On Friday, Semiconductor stocks got whacked as investors digested hotter-than-expected inflation and increased tensions between Ukraine and Russia.

Chipmakers had been enhanced by increased demand during the pandemic and have generally reported solid earnings and outlooks in the past month.

But investors are looking for less-risky stocks in an inflationary environment. On Friday, Reuters reported that chipmakers could face supply issues for critical components, including semiconductor-grade neon if Ukraine is invaded.

Among the biggest losers was AMD, which decreased 10% on Friday to a price of $113.14 per share. It’s down nearly 30% from its peak last November. Earlier this week, the chipmaker announced it had secured government approval to purchase Xilinx, which decreased almost 10% on Friday.

Marvell, a fast-growing company that makes chips for networking and storage, fell over 7% on Friday.

Under regulatory scrutiny, its significant acquisition for chip design firm Arm fell apart this week. It reports fourth-quarter earnings on Wednesday. On Friday, Nvidia also dropped over 7% and is down 30% from its peak last November.

Qualcomm fell over 5% and is now down over 11% in 2022. Intel fell over 2%, and Broadcom also ticked more than 3% lower.

The fall in chip stocks was a sector-wide slump, and many smaller names also fell on Friday. On Friday, the VanEck Vectors Semiconductor ETF, which trades under the ticker SMH, closed down over 5%.

The drop came between a rough day for the markets as the technology-heavy Nasdaq Composite decreased 2.78% and the Dow Jones Industrial Average decreased more than 500 points.

Stocks decreased sharply in the afternoon after a jump in oil prices tied to increased concerns about Russia invading Ukraine.

Treasury yields rose on Friday, which suggested that investors are also closely which follows the possibility that the Fed could hike interest rates faster than last expected. According to CPI data released this week, Goldman Sachs analysts expect seven rate hikes in response to inflation, surging 7.5% in January.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings