Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

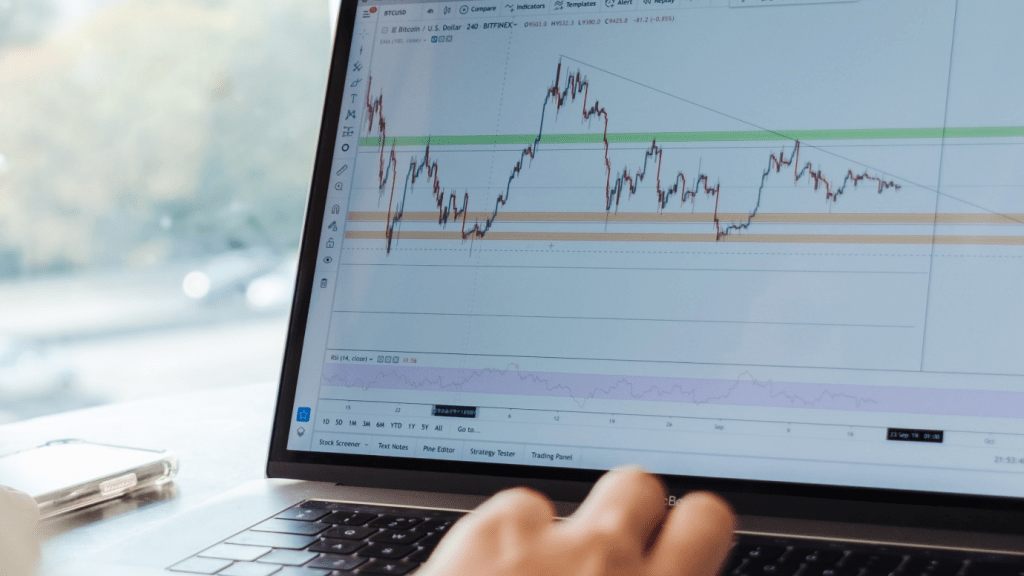

June 3, 2022: -On Thursday, U.S. stock futures increased as markets looked to bounce back from two days of losses.

Futures tied to the Dow Jones Industrial Average gained approximately 120 points or 0.4%. S&P 500 futures and Nasdaq 100 futures added 0.4% and 0.5%, respectively

“Our view is cautious as we close out the second quarter,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. “Global central bank uncertainty and the pace of tighter monetary policy, still-tight global energy markets leading to higher prices and headwinds for corporate profits growth is a risk for investors moving forward.”

Investors eyed employment data indicating the slowest job creation rate of the pandemic-era recovery. ADP reported that private-sector employment grew by just 128,000, losing the 299,000 Dow Jones estimate on Thursday.

Rates dropped as traders took the ADP report to mean the economy was already delayed, meaning the Federal Reserve could be less aggressive in tightening monetary policy. The benchmark 10-year Treasury yield pulled back over 0.02 percentage points.

Nvidia and Amazon both climbed nearly 1% in the premarket. Oil prices eased narrowly ahead of a critical decision from the Petroleum Exporting Countries regarding output.

Travel shares that would benefit the most from declining fuel prices grew in premarket trading. Shares of American Airlines and Carnival Corp each earned approximately 1%.

Investors also parsed through corporate earnings results. Shares of pet retailer Chewy increased roughly 18% premarket after the company reported strong quarterly results.

The moves came after considerable indexes posted losses back to back on Wednesday. The Dow cleared 176.89 points, or 0.5%, on Wednesday. The S&P 500 decreased almost 0.8%, and the Nasdaq Composite retreated 0.7%. The S&P 500 is off 1.4% this week, on rate for its 8th down week in the last 9.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings