Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

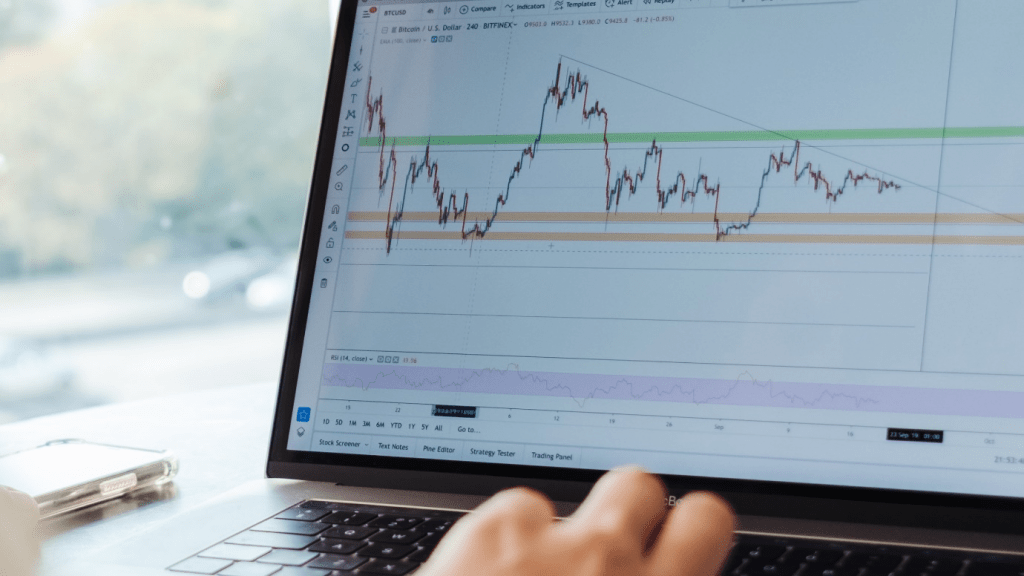

January 21, 2022: -On Wednesday, the Nasdaq Composite decreased again, bringing its decline from its November high to over 10% as investors continue to dump tech shares as interest rates spike to start the next year.

The technology-focused Nasdaq Composite dipped 1.15% to 14,340.26. Wednesday’s losses brought the index 10.7% off its latest record close in November 2021.

The Dow Jones Industrial Average decreased 339.82 points to 35,028.65, dragged down by a 3.1% decline in Caterpillar’s stock. The S&P 500 slid almost 1% to 4,532.76.

Elevated bond yields are plaguing the market this year as investors prepare for the possibility of more aggressive tightening by the Federal Reserve. The U.S. 10-year Treasury yield topped 1.9% earlier on Wednesday, its highest level as of December 2019. The 10-year rate started the year around 1.5%.

Growth stocks whose valuations ballooned in the pandemic led Nasdaq’s pullback from its November high. Shares of Peloton are off over 80% from their highs. Zoom Video has shed over 70%. Moderna, DocuSign, and Paypal are down more than 40% from their highs.

The rate spike has disproportionately hit the tech-heavy Nasdaq as tech stocks’ future earnings look less attractive when rates rise. Tech companies also rely on low rates to borrow for investing in innovation. The S&P 500 is just about 5% below its record close.

“Investors worry that higher rates and tighter financial conditions will lead to valuation compression, in effect undoing much of the Fed’s decade-long largesse,” Jack Ablin, Cresset Capital founding partner and CIO told clients.

Equities are declining despite a slew of strong corporate earnings results. Bank of America beat Wall Street estimates to release pandemic-related loan loss reserves. Shares rebounded 0.4% a day after sliding 3.4%. Other bank stocks were in the red.

Morgan Stanley saw its stock increase 1.8% after its fourth-quarter profit topped estimates. It also experienced a 13% increase in equities trading revenue.

Procter & Gamble shares popped almost 3.4% after the consumer giant reported fiscal second-quarter earnings and revenue that topped Wall Street’s expectations. The company raised its outlook for sales growth.

“Higher inflation is raising concerns about input costs for many companies. Since margins were fine, this has relieved some of those concerns,” said Matt Maley, chief market strategist at Miller Tabak + Co.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings