Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

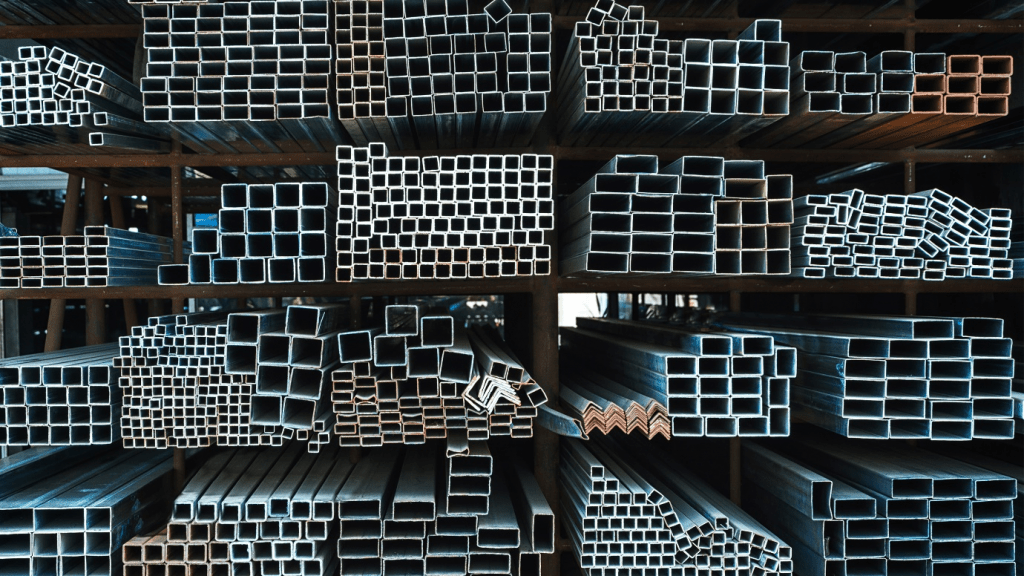

February 25, 2022: -Commodities prices increased across the board amid fears of a supply disruption after Russia invaded Ukraine. Russia is a key producer and exporter of not just energy but metal and grains, too. Markets were already tight ahead of the invasion, meaning there’s little ability to absorb any output cuts.

“With base metals inventories already running extremely low, there is a tiny additional cushion for further supply disruptions — either from Russia directly or via higher-for-longer gas and power prices,” JPMorgan said in a note to clients.

Aluminum prices jumped more than 3% to hit a record high of $3,450 per ton on the London Metal Exchange. Nickel is now trading at the highest level in more than a decade: around $25,000 per ton.

Platinum jumped more than 2%, while palladium surged more than 6%.

Russia is a vital producer of all four metal. According to data from Cru, the country supplies 35% of the world’s palladium and 10% of world platinum. Aluminum, nickel, and crude steel production stands at 6%, 5%, and 4%, respectively.

″[A]luminum and nickel are making further gains amid fears that these two base metals could suffer supply outages from Russia as sanctions are imposed, and counteraction is taken,” Commerzbank said Thursday in a note to clients.

Wheat prices jumped to the highest level in more than nine years, while corn futures also advanced.

Oil surged more than 8%, breaking above $100 per barrel for the first time since 2014. West Texas Intermediate crude futures, the U.S. oil benchmark, traded as high as $100.54 per barrel. Brent crude, the international standard, traded above $105.

“Though there have been no physical supply disruptions yet, there are serious concerns that Russia could move to restrict commodity exports in response to U.S. sanctions,” RBC said on Thursday.

“With the notable exception of the Nord Stream 2 pipeline project, which has already been halted, the White House has gone to great lengths to convey that it will not target the Russian energy sector and exacerbate an already tight supply situation,” the firm added.

Natural gas futures jumped 4.6% to trade at $4.835 per million British thermal units.

Europe’s move was far more extreme, with prices increasing more than 30%. Russia supplies around one-third of Europe’s natural gas.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings