Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

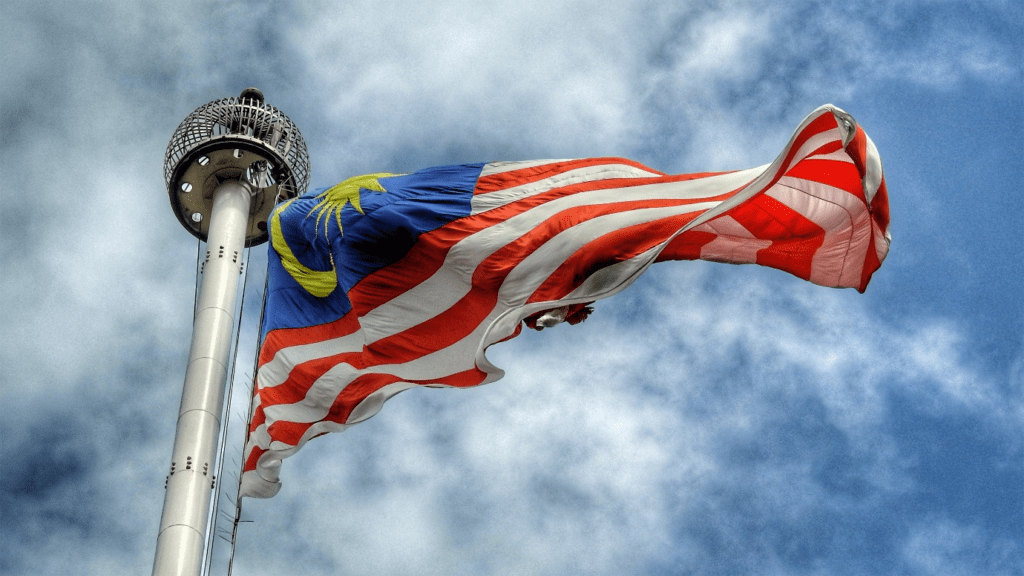

December 7, 2021: -On Monday, Malaysia is not “as concerned” about investors pulling out of the country in a big way when the U.S. Federal Reserve starts winding down its asset purchases, the Malaysian finance minister told CNBC.

Tengku Zafrul Aziz, the finance minister, said Malaysia’s financial markets are “insulated” as the country has raised most of its debt locally. The government increased its statutory debt ceiling from 60% to 65% of gross domestic product to fund its Covid-related fiscal packages.

“If you look at our borrowing exposure, 98% is ringgit-denominated,” Zafrul told CNBC’s “Squawk Box Asia,” referring to the Malaysia currency.

“So we’re not as concerned,” he added. “But having said that, of course, there will be some effect as markets react accordingly in the U.S.”

The Southeast Asian country was among those that suffered a “taper tantrum” in 2013 when U.S. Treasury yields surged after the Fed said it would taper its quantitative easing program.

That led to sharp money outflows from many emerging markets — weakening their currencies and forcing their central banks to hike interest rates to protect their capital accounts.

This time, the Fed is set to start tapering when global debt has risen after governments increased spending to cushion the economic hit from the Covid-19 pandemic. That could leave some countries vulnerable, especially those that borrowed in U.S. dollars.

Analysts have said that many emerging markets, particularly those in Asia, have better economic conditions that would allow them to withstand rising U.S. yields better.

The Malaysian economy is on track to grow by 3% to 4% this year, said Zafrul. But next year’s growth prospects would depend on whether the country could continue to open up, given the threat of the Covid omicron variant, the minister added.

“I’m quite optimistic that we can do what’s needed to be done,” said Zafrul. “Having said that, you never know, right? So let’s prepare for the worst, but at the same time, do not panic.”

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings