Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

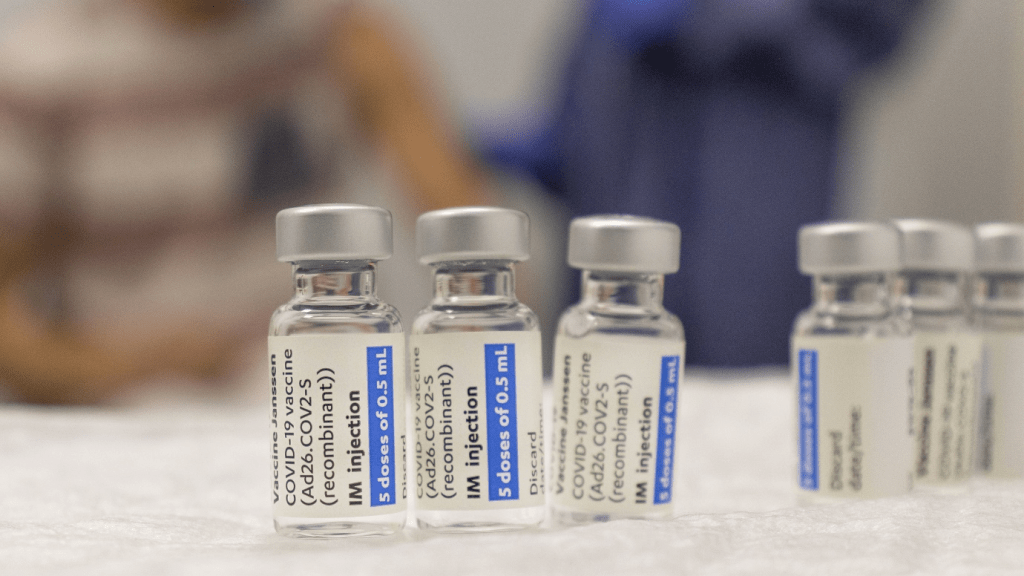

April 20, 2022: On Tuesday, Johnson & Johnson ( J&J ) lowered its full-year sales and earnings outlook and stopped providing Covid-19 vaccine revenue guidance because of a global supply surplus and demand uncertainty.

J&J forecasts sales of $94.8 billion to $95.8 billion, about $1 billion less than the guidance provided in January. The company lowered its adjusted earnings per share by 25 cents to $10.15 and $10.35 for the whole year, from the last forecast of $10.40 to $10.60.

J&J reported first-quarter sales of $23.4 billion, slightly missing Wall Street expectations but growing 5% over the same quarter last year. The company posted earnings of 2.67 cents per share, beating expectations and increasing 3.1% over the same period of 2021. J&J reported a net income of $5.15 billion, a nearly 17% decrease over the first quarter of 2021.

CFO Joe Wolk said Tuesday that developing nations have limited capacity in terms of refrigeration and getting shots in arms, which has created a backlog of vaccines. The company sold $457 million of its Covid vaccine globally. When asked about no longer providing a sales outlook for the photos, Wolk said it was unusual to guide a specific product, to begin with.

“We did it last year because we understood the Street had an expectation or at least an excitement around understanding how vaccine sales might play out, but it was never material,” Wolk told CNBC’s Meg Tirrell on “Squawk Box,” noting the vaccine is not for profit and doesn’t impact the company’s bottom line. He said Covid vaccine sales met J&J’s internal expectations.

J&J reported $12.87 billion in pharmaceutical sales, a raise of 6.3% over the same quarter in the previous year. The company’s medical devices business grew by 5.9% to $6.97 billion in sales compared with the first quarter of 2021. Sales at J&J’s consumer health business, which it is spinning off into a separate publicly-traded company, declined 1.5% to $3.59 billion.

In pharmaceuticals, Wolk said recent prescriptions slowed in early January when the Covid omicron variant swept the U.S. but picked up in February and March. He said J&J’s medical devices business led the company’s growth with an uptick in general and advanced surgery and orthopedics. The company’s medical devices segment has struggled during Covid increases when elective procedures are delayed because hospitals are overwhelmed with sick patients with the virus.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings