Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

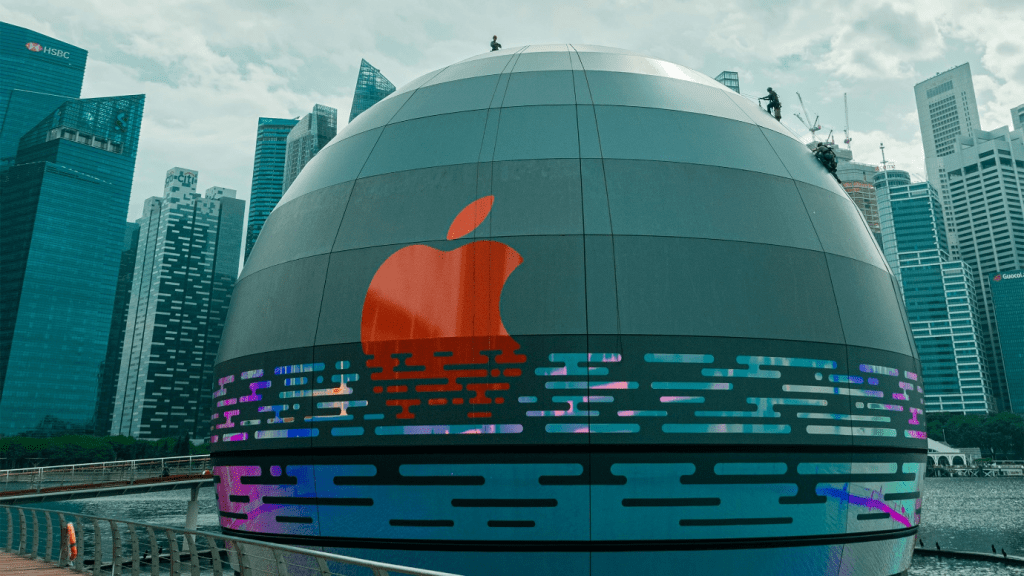

May 16, 2022: -Apple stock decreases 8%, which wipes out about $200 billion in value and drags down the Dow and Nasdaq indexes. The iPhone maker is in a bear market alongside different technology giants.

Apple has decreased during a lousy week for equity markets, which sells off stocks in almost every industry on fears of Fed rate hikes, weakening consumer confidence, surging inflation, and global supply chain challenges. The Nasdaq Composite is down over 7% this week and is on speed for a six-week losing streak.

Apple faces some supply chain challenges, but the outlook for its business hasn’t changed this week.

The company has typically been viewed as a “safe” place for investors to park their money. The fact that it’s being sold off alongside everything else is a bad sign for other stocks and deteriorating investor confidence.

On Thursday, Renaissance Macro Research’s Jeff DeGraff told CNBC that there’s nowhere to hide in a bear market, even in Apple.

“For tech, when they start taking out the leadership in tech, that’s a better sign that they’re starting to take everything,” DeGraff said.

“We assume that the AAPL sell-off will continue, not because we know anything about this quarter’s iPhone shipments or services revenue, but because we believe that once investors start selling best-of-breed names, they are rarely done in one day,” said Datatrek co-founder Nick Colas on Thursday.

That trend marked a notable reversal from last November when growth-heavy tech stocks started to decrease, and Apple often attracted investors who sought a lower-risk bet on tech.

Apple still has prodigious cash flow, enabling it to endure slowdowns and return a profit to shareholders. The company generated $28 billion in operating cash flow in the March quarter on total sales of $97.3 billion. It said it spent $27 billion during the quarter to repurchase its shares and pay dividends.

And weakening consumer confidence has not started to hurt iPhone sales. In fact, in the March quarter, every single one of the company’s businesses grew except for iPads, which Apple blamed on a chip shortage.

When CEO Tim Cook was asked regarding the effects of macroeconomic conditions and inflation on its business in an earnings call last month, he said a huge problem was making enough iPhones and Macs to meet global demand, not a slowdown in demand.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings