Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

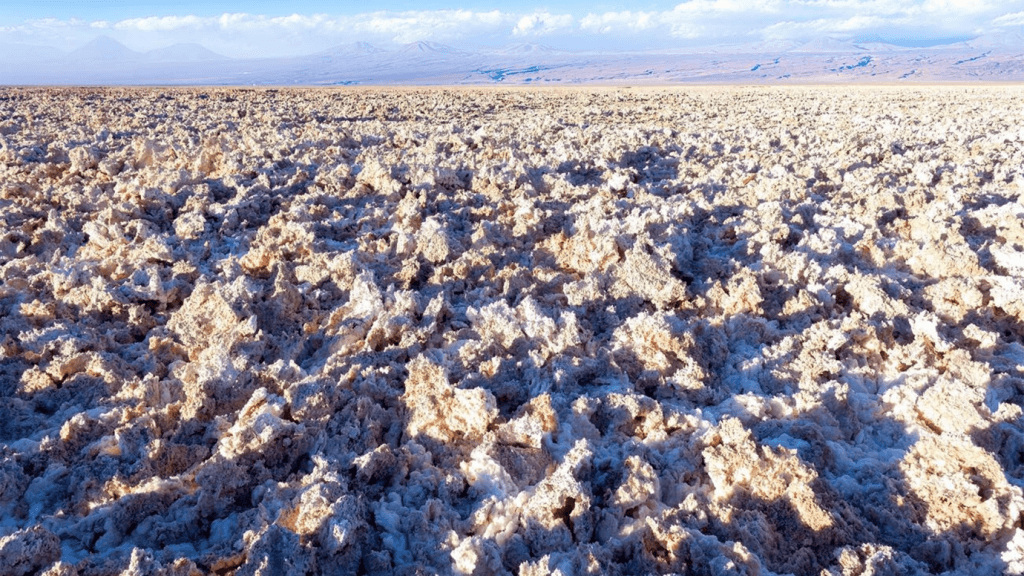

March 7, 2023: Iran declares that it’s found a massive deposit of lithium, a key place in batteries for things and electric vehicles, in its western provinces.

“For the initial time in Iran, a lithium reserve is discovered in Hamedan,” a mountainous province in the west of the country, Mohammad Hadi Ahmadi, an official at the ministry of industry of Iran, mines and trade, was quoted which stated on Iranian state television on Saturday.

The lucrative element is critical in the cathodes of lithium-ion batteries in EVs and rechargeable batteries such as those used in cell phones. The metal’s price has zoomed in the previous year because of the higher demand for electric vehicles areas, global supply chain problems and inflation, but decreased more recently, undergoing a correction between a decrease in EV sales and slow business activity in China, the fastest-growing EV market.

If true, Iran’s lithium deposit news would be a lifeline for the country’s battered economy.

Weighed down by vast years of heavy international sanctions and faced with a spiralling currency, which hit its lesser point against the dollar in February, Iran would benefit significantly from the ability to export such valued resources through its trading partners would likely be limited because of those sanctions.

Isolated from the international financial system, Iran continues to draw penalties from Western nations that are accusing Tehran of supplying Russia with weapons that are being used in its war in Ukraine. Iran’s government has also spent almost six months cracking down violently on women’s rights and anti-administer protesters.

Regarding the international lithium market, such an accumulation to the world’s known state could push metal prices further, depending on Iran’s capacity to export.

Iran is one of the top oil and gas producers. Still, its inability to export widely because of the sanctions has slashed its ability to bring in revenue and FX and contribute to global supply.

“Over the next 9-12 months, we are increasing more constructive on base metals, whilst anticipating a move lower in lithium costs alongside cobalt and nickel,” a report from the bank’s things research desk from February is writing.

In the next two years, Goldman anticipates lithium’s supply to increase by 34% annually, led by Australia and China, holding some of the world’s most extensive metal supplies.

“Hence, whilst a recovery in sales of EV into 23Q2-Q3 could temporarily lift sentiment and help decrease battery metal costs, the likely supply surge and downstream overcapacity are set to bring lithium prices down in the medium term,” the bank wrote.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings