Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

February 2, 2022: -GlobalWafers, a Taiwanese firm that makes silicon wafers for computer chips, will no longer buy Munich-headquartered rival Siltronic after policymakers in Germany failed to approve the deal in time.

The deal’s collapse late on Monday evening comes as nations look to bolster their “tech sovereignty” so they don’t have to rely on other countries for critical technologies like semiconductors. Europe is heavily reliant on the U.S. and Asia, home to companies such as Samsung, TSMC, and Intel.

“The takeover offer by GlobalWafers and the agreements which came into existence as a result of the offer will not be completed and will lapse,” GlobalWafers said on Tuesday.

Germany’s Economic Ministry could not clear the 4.35 billion euro ($4.9 billion) deal by the January 31 deadline, which means that the proposed acquisition can’t go ahead as planned.

“It was impossible to complete all the necessary review steps as part of the investment review. This applies in particular to the review of the antitrust approval by the Chinese authorities, which was only granted last week,” a spokesperson for Germany’s Economic Ministry said, according to Reuters.

The takeover, approved by regulators in China on January 21, would have created the second-biggest maker of 300-millimeter wafers behind Japan’s Shin-Etsu.

GlobalWafers will have to pay a termination fee of 50 million euros to Siltronic.

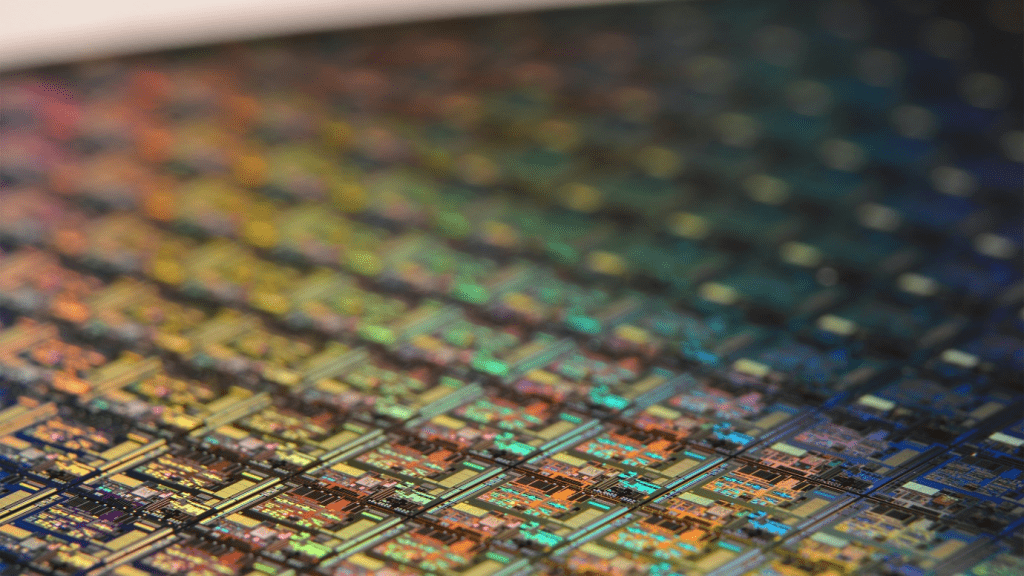

Wafers are a crucial building block in the chips used to power everything from iPhones to car parking sensors.

Germany, home to Infineon and several other chipmakers, has grown increasingly wary about the semiconductor global supply chain after a worldwide chip shortage hurt its well-known car industry.

The ministry said that an investment review would be carried out again if GlobalWafers chose to make a new acquisition attempt.

Doris Hsu, CEO of GlobalWafers, said that the outcome was “very disappointing,” which adds that the firm will “analyze the non-decision of the German government and consider its impact on our future investment strategy.”

In a statement, the company said, “Europe is remaining an important market for GlobalWafers, and it was remaining committed to the customers and employees in the region.”

Shares of Siltronic were up more than 2% in morning trade Tuesday on the Frankfurt Stock Exchange.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings