- February 13, 2026 10:07 am

- California

The COVID-19 is an unprecedented crisis that has led to a colossal number of casualties and security issues. To reduce the spread of Covid, individuals regularly wear masks to protect themselves. This makes facial recognition a somewhat troublesome issue since specific regions of the face would be covered up.

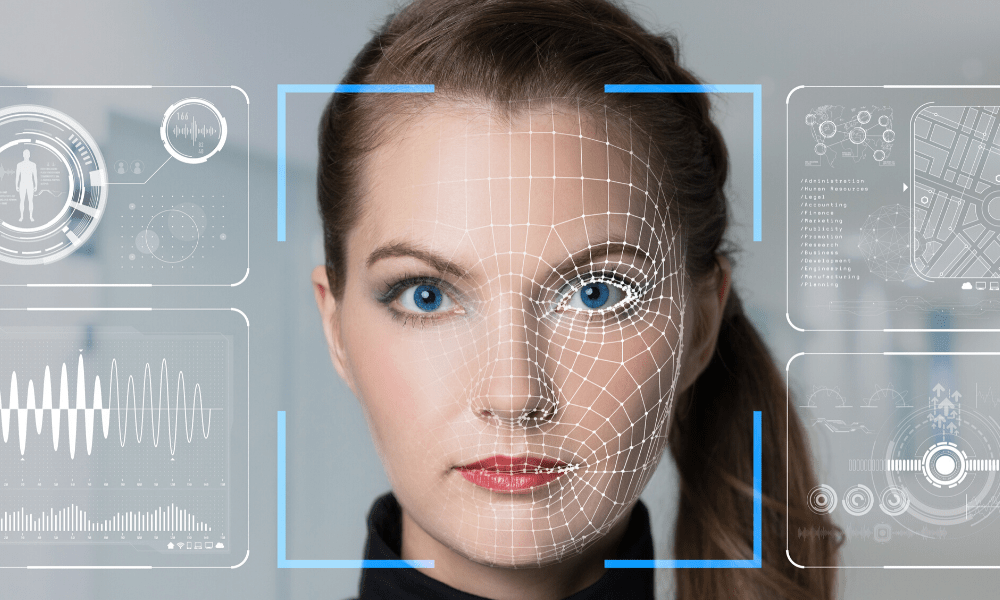

Facial recognition has consistently been one of the most entrancing and fascinating advancements as it directly deals with humans. The Coronavirus flare-up has impelled the world to move towards touchless facial recognition technology. It is picking up colossal traction globally owing to its contactless biometric features. Organizations are disposing of traditional fingerprinting scanners and providing enormous business opportunities by adopting AI-based facial recognition technology. Some of the crucial usage applications are security and surveillance, digital healthcare, photo retrieval, etc.

As mentioned, opportunities and challenges go inseparably. Developing commercial interests for face recognition is responsive and encouraging. However, it likewise ends up being a challenging undertaking regarding issues related, which have continuously played with its quality of delivery. These challenges emerge when the circumstances are non-agreeable and cause a change in facial appearance/expressions.

As per a study published by the National Institute of Standards and Technology (NIST), part of the U.S. Division of Commerce, face recognition algorithms delivered before the COVID-19 pandemic can endure up to 50% authentication failure rates when the subjects wear face masks.

Wearing masks as a social distance measure demonstrates viability in preventing the spread of the virus. Hence, a face recognition framework at present may need to conduct operations with primary facial features as noses and mouths obscured from view.

The NIST study (https://rb.gy/psrmvn) ran under the Ongoing Face Recognition Vendor Test (FRVT) standard set up by the organization, against a bunch of photographs utilized for FRVT benchmarks since 2018, drawn from unmasked application photos of people applying for immigration benefits and border crossing photos of travelers entering the United States.

They were applying digital masks to the border crossing photographs permitted controlled investigation of varying factors like the shape of the mask, mask color, and nose coverage. The procedure also allowed the creation of huge datasets. The application photos didn’t get masks, to copy a situation where an individual wearing a mask attempts to authenticate against a prior visa or passport photo. Over 6 million pictures of more than 1 million individuals tested against 89 face recognition algorithms.

However, mask shape affected performance. Full-face-width masks covered more of the face than a rounder N95-type mask, bringing about a false-negative rate twice that of rounder-type masks. The study considered light blue and black mask colors with black masks giving higher error rates. Few of the algorithms couldn’t identify a face completely when the subject wore a mask.

NIST stresses that the study does not account for possible algorithm fine-tuning or the effect of human examination’s ability to correct false positives. Regardless, while NIST measures algorithmic performance and does not make recommendations for future activity, its information, however, suggests that new post-pandemic algorithms expect advancement to allow face recognition systems to give accurate outcomes in the pandemic environment.

No spam, notifications only about new products, updates.