Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

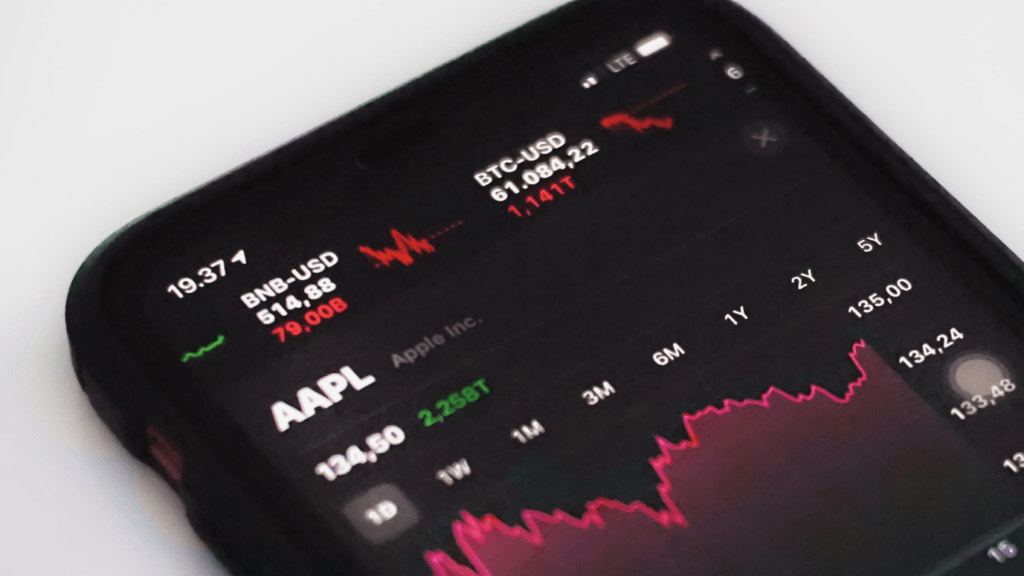

October 19, 2021: -Apple shares bounced back on Thursday, but losses since its record highs remain sharp. Since that September peak, the stock has fallen 9%, shedding roughly $229 billion in market cap, and that’s equivalent to the market cap of 94% of the S&P 500 companies. Recently, the shares dropped on reports it would cut iPhone production in response to a shortage of chips.

Nancy Tengler, chief investment officer at Laffer Tengler Investments, has been a long-term holder of the name.

On Wednesday, “We became shareholders in 2013 when the yield on the stock rose above 3%, which was well above the yield on the 10-year, and we did that because we liked the services model, and we thought the market was undervaluing that,” Tengler told CNBC.

While the firm still holds its position, it has reduced its exposure to around 2% of total holdings. After this sell-off, Tengler said it could be time for investors to add to their position.

“At this level, if you’re not as valuation sensitive as we are at Laffer Tengler, you probably do want to view this as an opportunity to almost initiate a position or add to holdings,” she added. “The reason is this is a supply chain problem; it’s not the problem of the demand, and we think Cook and company have that well in hand, so I say this is a time to add to holdings if you’re a buyer.”

Jeff Kilburg, chief investment officer at Sanctuary Wealth, seeing the latest weakness tied to the chip shortage as just background noise for Apple.

“These semis shortages are expected, but if we see Apple deliver 10 million fewer iPhones, I think that is just splitting hairs. We see the 200-day moving average at $135, and I think that presents a great opportunity,” Kilburg said during the same interview.

Apple traded at $143 on Thursday afternoon. A decline to $135 implies a 6% downside.

“It’s an essential name that you have to own, and they’ve presented a nice little pullback here, so I think you embrace it with open arms,” Kilburg added.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings