Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

June 18, 2021: -One of the world’s most prominent wealth managers doesn’t think artificial intelligence can replace the role of financial advisors.

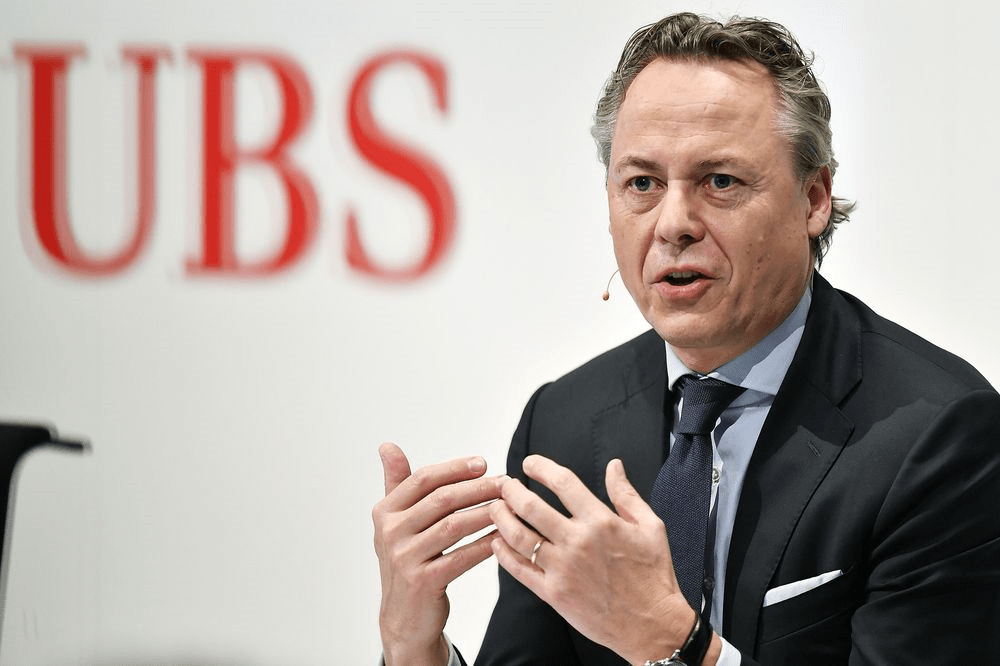

On Wednesday, Ralph Hamers, the CEO of UBS, said that technologies such as AI were better suited to day-to-day handling functions such as opening an account or executing trades than advising clients.

“There is no added value for client advisors to be engaged in the process like that,” Hamers told CNBC’s Geoff Cutmore at the virtual CNBC summit.

“The technology should

support our financial advisors,” Hamers said, that adds AI could be used to make sense of the research and other data that advisors don’t take time.

“That is what artificial intelligence can do because even our client advisors cannot read all the research that is there,” he added.

“Our client advisors can’t comprehend all the product options that are out there,” he added.

The banking industry of Europe has seen radical change over the last decade, with new entrants like Monzo, Revolut, and N26 that emerge to take on incumbents with slick, digital-only services.

Covid-19 has accelerated digital transformation in the banking sector, with lenders racing to move away from their aging IT systems to cloud-based technology. Some partner with tech companies like Microsoft, Amazon, Google, and fintech upstarts to hasten the process.

Hamers said UBS wants to adopt a “Netflix experience” where clients can access a “dashboard” of further research and products to choose from.

“That’s where things go, and that’s where UBS is making the next step, in terms of dealing with technology to provide a much better service for our clients,” he further said.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings