Industry 4.0 and the future of manufacturing

n recent years, Industry 4.0 has become a popular buzzword in the manufacturing industry, and for a good reason. The fourth industrial revolution …

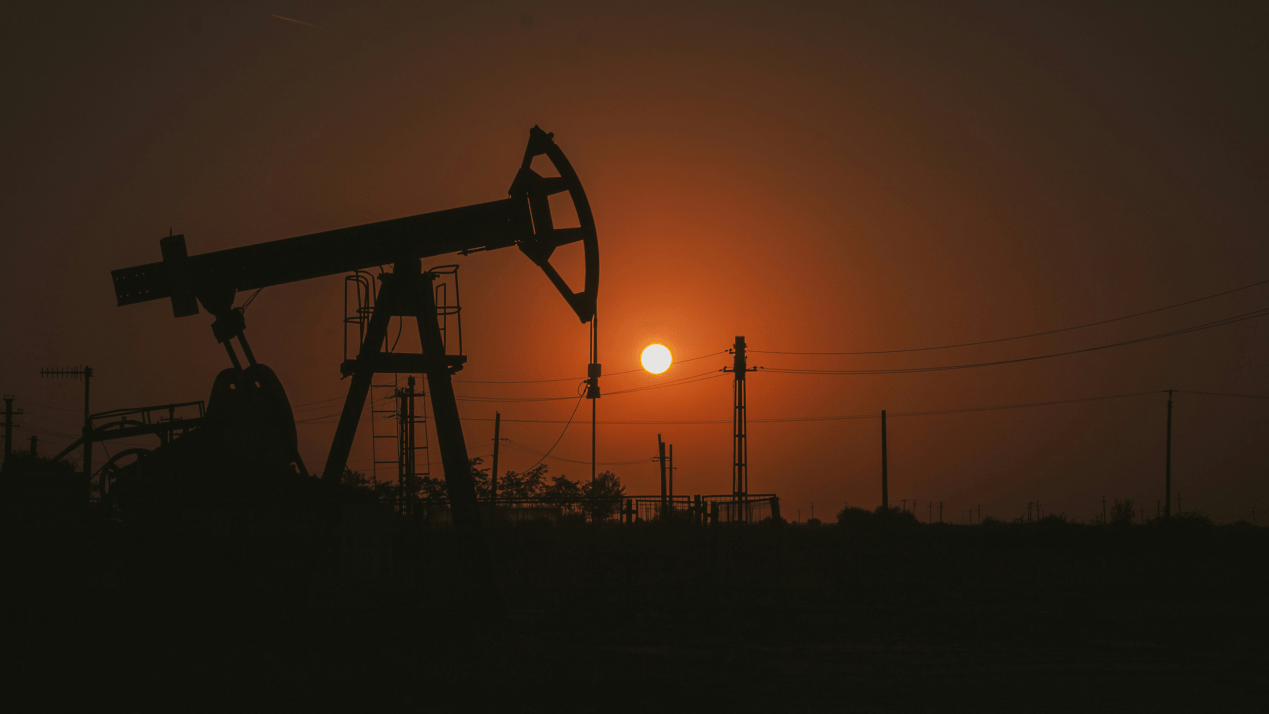

The global benchmark for crude oil, West Texas Intermediate (WTI), exhibited a lack of clear directional movement on Monday, April 15th, 2024. This price stagnation occurred despite a recent escalation of tensions within the Middle East, a region historically exerts significant influence on global energy prices.

According to FXStreet, a financial news organization, WTI crude oil prices hovered near the $85.00 per barrel mark throughout the Asian trading session. This price point reflects minimal movement compared to the previous week’s close. This lack of response to geopolitical developments is somewhat unexpected.

Earlier reports indicated a potential attack by Iran on Israeli targets over the weekend. Such an event would typically trigger concerns about potential disruptions to oil supplies from the Middle East, leading to a rise in crude oil prices. However, WTI prices remained relatively stable in the face of this news.

Analysts have postulated several reasons for this price inertia. Firstly, some market participants may be adopting a wait-and-see approach, seeking further clarity on the unfolding situation in the Middle East before adjusting their trading positions. Additionally, ongoing concerns about a potential global economic slowdown could be dampening overall demand for oil, counteracting any potential price surge triggered by the regional tensions.

Furthermore, the possibility of increased oil production from other sources, such as the United States, could also be mitigating upward pressure on prices. The ongoing negotiations surrounding a potential revival of the Iran nuclear deal might also be influencing market sentiment. A successful outcome of these talks could lead to a relaxation of sanctions on Iranian oil exports, potentially increasing global supply and exerting downward pressure on prices.

Looking ahead, the trajectory of WTI crude oil prices will likely depend on several factors. The evolution of the geopolitical situation in the Middle East will be closely monitored, with any further escalation potentially triggering a price increase. Additionally, upcoming economic data releases and developments surrounding the Iran nuclear deal negotiations will also be influential.

In conclusion, despite the recent escalation of tensions in the Middle East, WTI crude oil prices exhibited surprising stability on Monday. A combination of factors might contribute to this price stagnation, including a wait-and-see approach from market participants, potential economic slowdown concerns, and the possibility of increased oil production from other sources. The coming days and weeks will be crucial in determining whether the geopolitical situation or other factors will ultimately significantly influence the global oil market.

n recent years, Industry 4.0 has become a popular buzzword in the manufacturing industry, and for a good reason. The fourth industrial revolution …

The ability to manage one’s financial conditions is driving the adoption of AI in personal finance – consumers are starving for financial …

In today’s global economy, supply chains have become increasingly complex and interconnected, making them vulnerable to natural …

Manufacturing processes are now more adaptable, energy-efficient, and environmentally friendly thanks to the development of numerous …