Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

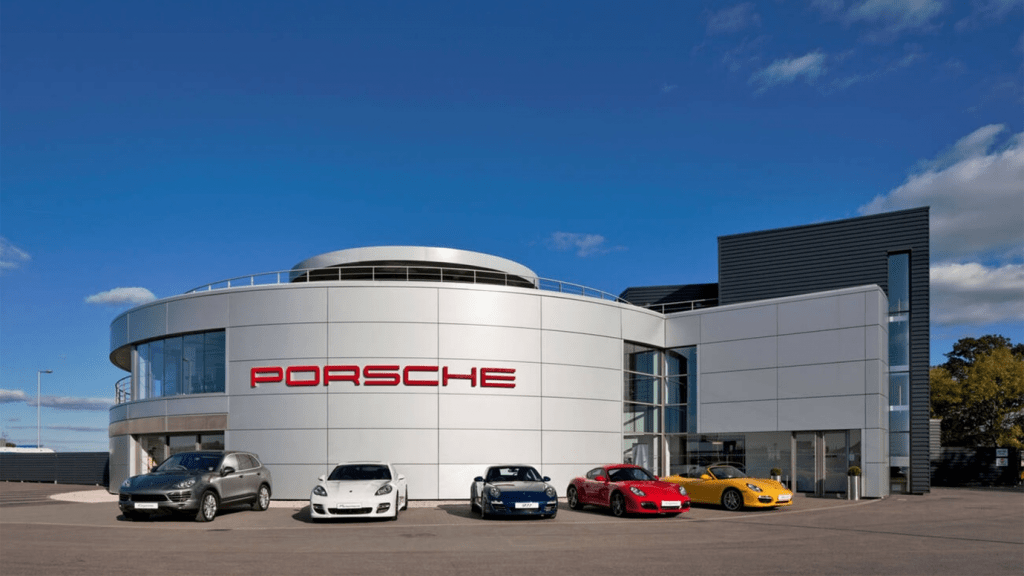

September 20, 2022: -On Monday, Volkswagen shares increased after the carmaker said it was aiming for a valuation of up to 75 billion euros for sportscar brand Porsche, in Europe’s third biggest IPO.

Porsche aims to win for investors with its stable brand and high operating margins even as the stocks of different luxury carmakers such as Ferrari and Aston Martin have lamented this year amid the tumult in European stock markets.

On Sunday, the valuation informed of 70 billion-75 billion euros is just below some investors’ assessments of up to 85 billion euros. Still, it far outstrips the valuation of other German carmakers, such as BMW’s 49 billion euros or Mercedes-Benz’s 61 billion.

It comes close to Volkswagen’s market capitalization of 88 billion euros. The carmaker saw its shares increase 3% in premarket trade. By 0914 GMT, they were higher at 145.6 euros, from 145.46 at Friday’s close, but had a drop in European shares.

While the IPO could still be taken out before trading starts on September 29, Porsche AG’s Chief Financial Officer Lutz Meschke said this would happen in the possibility of new “severe geopolitical problems.” Analysts have added that Volkswagen could see its valuation bumped up by the listing to showcase the worth of just one of its premium brands, then experienced its shares increase by 3% in premarket trade. Still, by 0838 GMT, they were up only 0.4% from Friday’s close.

The carmaker is planning on placing up to 12.5% of Porsche’s share capital with investors in the form of permissible shares, which do not carry that vote rights.

Already, cornerstone investors have laid claim to nearly 40% of the share capital on offer; Qatar Investment Authority, Volkswagen’s third-biggest shareholder, has committed to purchase 4.99%. In contrast, the statement on Sunday said that Norway’s sovereign wealth fund and T. Rowe Price bought shares worth 750 million euros.

Abu Dhabi’s ADQ will purchase shares worth 300 million euros.

“The Porsche IPO will be a success for investors to queue up. If the Porsche IPO goes good, one could be thinking of placing other parts like Audi on the stock exchange,” auto expert Arndt Ellinghorst of data analytics company QuantCo said.

Analysts are comparing the Porsche AG stock to Ferrari, with a market capitalization of 38 billion euros but an ongoing margin of 24% to Porsche’s 17-18%. The German carmaker targets a 20% margin and is far ahead in electric vehicles.

But a few investors have expressed caution more than complex governance issues at Porsche AG, with Chief Executive Oliver Blume running the sportscar maker and the Volkswagen Group and Porsche SE retaining a significant stake.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings