Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

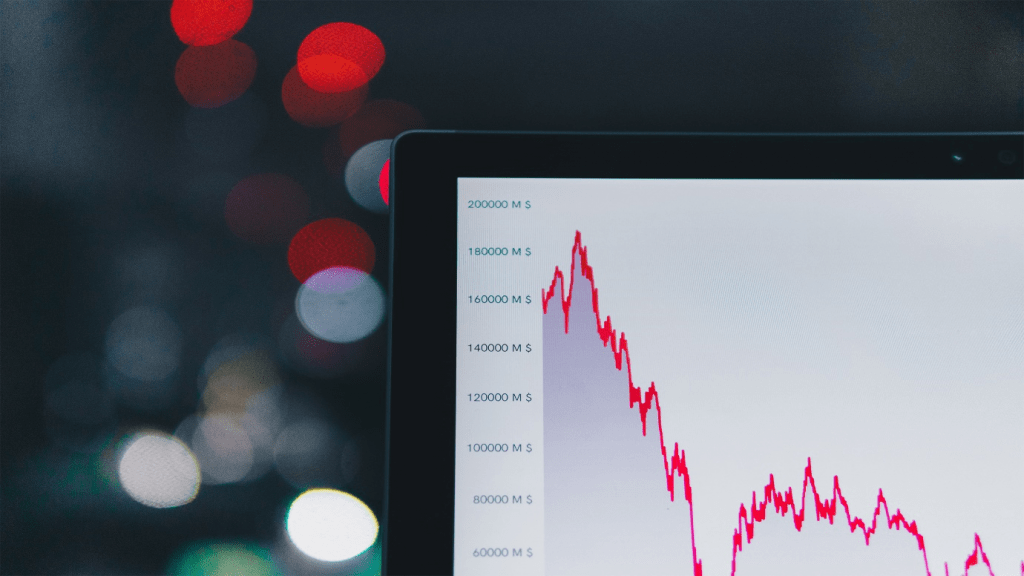

January 31, 2022: -After a blockbuster year for venture capital deals, some investors worry the boom times may not last much longer.

According to C.B. Insights, tech start-ups raised a record $621 billion in venture funding globally in 2021, up more than double from a year earlier. The number of privately-held “unicorn” firms valued at $1 billion or more increased 69% to 959.

Private companies like Stripe and Klarna saw their valuations swell to the tens of billions of dollars, aiding by a flood of cash due to ultra-loose monetary policy and the acceleration of digital adoption during the Covid-19 pandemic.

Recently, with the Federal Reserve hinting at planning to hike interest rates in a bid to cool increasing prices, investors in high-growth tech firms are getting cold feet. The Nasdaq Composite has fallen more than 15% this year as fears of tighter policy have led to a rotation out of growth stocks into sectors that would benefit from higher rates, such as financials.

In the private markets, panic over the tech sell-off is starting to set in. V.C.V.C. investors say they’re already hearing about deals being renegotiated at lower valuations and even the withdrawal of term sheets. Later-stage companies are likely to be the most brutal hit, they say, while some firms’ planning to go public could get put on hold for the foreseeable future.

“It’s trickling through to the private markets and the later-stage rounds,” said Ophelia Brown, founder of Blossom Capital. “Term sheets are being renegotiated. Few term sheets have been pulled.”

The shift in tone echoes negative sentiment on start-up investing around the start of the Covid pandemic. In March 2020, Sequoia warned founders of “turbulence” in a blog post reminiscent of its 2008 presentation “R.I.P. Good Times.” The Silicon Valley firm was right for a brief period: several start-ups saw their valuations slashed initially, while others had term sheets pulled.

But what followed was a banner year for start-up investment, with companies increasing $294 billion in 2020 globally. Hedge fund giant Tiger Global became a huge driving force in the market, backing tech firms much earlier than before as traditional investors sought out returns through alternative assets.

Brown thinks few of the reaction in public and privately-traded tech stocks has been overdone. However, most start-ups should weather a changing economic cycle, given the mountain of cash available in private markets.

“There is still so much dry powder for recent funding rounds,” she said. “The companies have been very well funded that, unless they were being completely reckless with the cash, they should be able to see this through.”

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings