Boost Your Productivity and Profits: The Accounting Software You’ve Been Waiting For!

Once upon a time, a group of entrepreneurs found themselves tangled in a web of financial complexities in the bustling kingdom of …

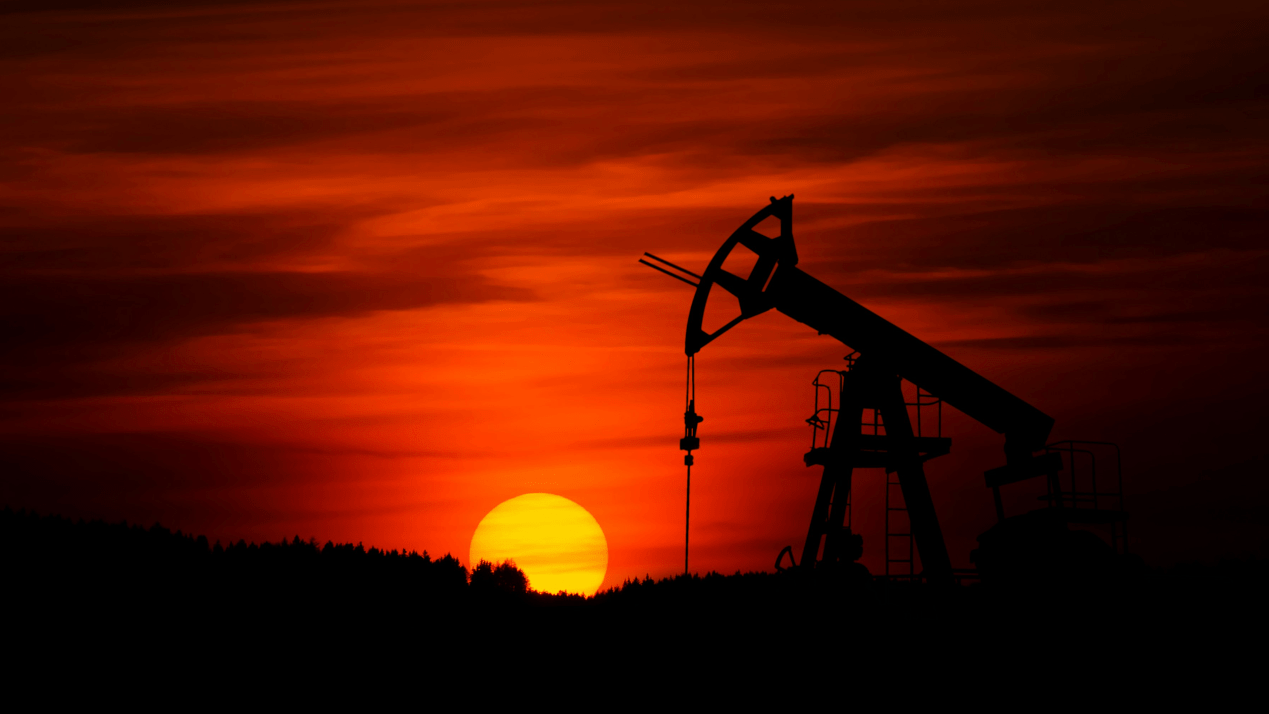

Crude oil prices surged by 2% on Thursday, trading above $70 per barrel. The rally was fueled by the decision of the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) to delay increasing oil production.

The OPEC+ alliance, which includes Saudi Arabia, Russia, and other major oil producers, had previously announced plans to gradually increase oil production. However, the recent decision to delay this increase has tightened global oil supplies and increased prices.

Several factors influenced the decision to maintain current production levels, including concerns about global economic growth and the ongoing geopolitical tensions in various regions. OPEC+ aims to support oil prices and ensure a stable market by limiting oil production.

The rise in crude oil prices has implications for various sectors of the economy, including transportation, manufacturing, and energy. Higher oil prices can increase costs for businesses and consumers, potentially impacting inflation and economic growth.

The future trajectory of oil prices will depend on several factors, including global economic conditions, geopolitical developments, and the decisions made by OPEC+. As the world continues to navigate these uncertainties, oil prices will likely remain volatile.

Once upon a time, a group of entrepreneurs found themselves tangled in a web of financial complexities in the bustling kingdom of …

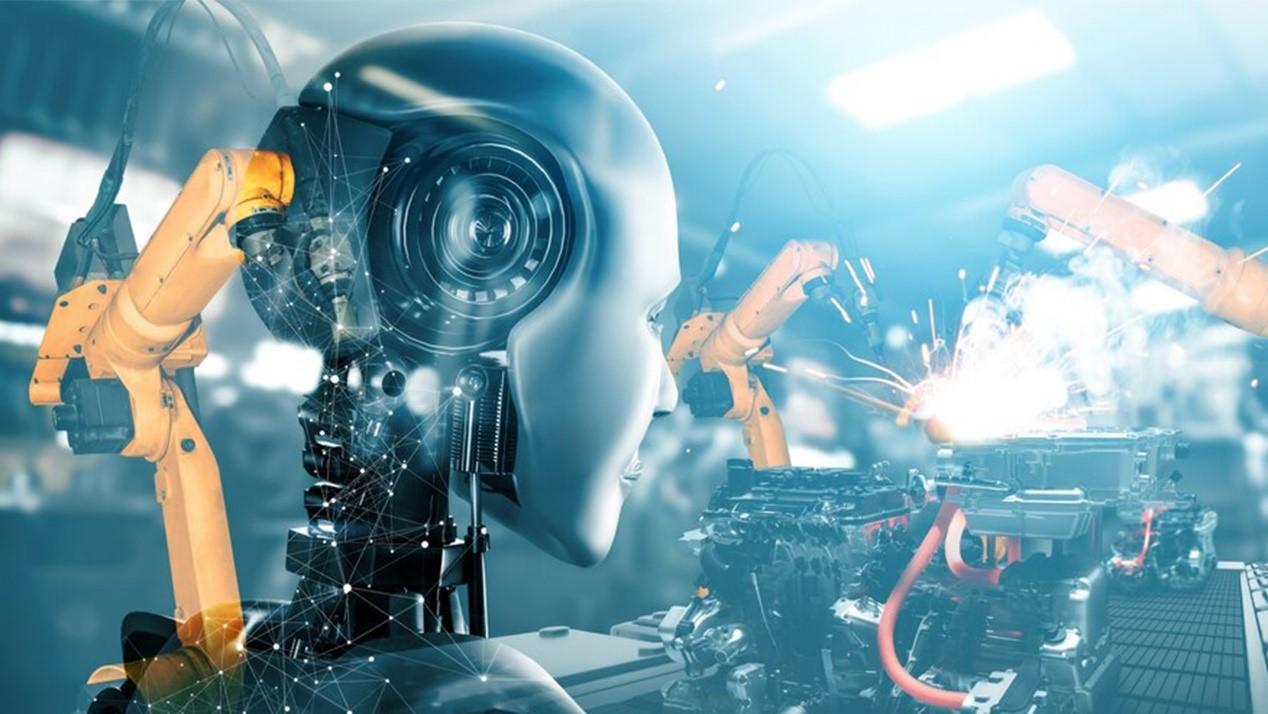

A profound revolution is underway in the labyrinth of time, where the threads of innovation and industry intertwine. Modern factories, akin to …

A new study indicates that including social determinants of health in sepsis readmission models could …

In the annals of human history, the art of manufacturing has undergone a metamorphosis so profound that it has reshaped …