Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

The SPAC Opportunities Forum is brought to you by Opal Group, a global conference organizer which creates large networks of top industry leaders

The event will focus on the structure of a ‘special purpose acquisition company’ or SPAC which is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. Also known as “blank check companies,” SPACs have been around for decades. In recent years, they’ve become more popular, attracting big-name underwriters and investors and raising a record amount of IPO money. Seeing over a 200% increase in SPAC M&A deal activity in 2020 compared to 2019, with that trend expected to continue in 2021 and beyond. SPACs are generally formed by investors, or sponsors, with expertise in a particular industry or business sector, with the intention of pursuing deals in that area.

This event will bring together Family Offices, Private Equity Funds, Hedge Funds, Investment Banks, Venture Funds, Auditors, Equity Managers, Mutual Funds, Pensions, Endowments, Foundations, Law Firms, Real Estate Firms, Private Companies & Start-Ups and other Institutional Investors interested in learning more about SPAC’s and potentially entering the space. Our agenda will cover topics ranging from SPAC Market Outlook, SPAC Deal Structure, Legal & Accounting, Insuring SPAC Deals, Idea Origination & Deal Flow, Comparing IPO’s vs SPAC’s, PIPE Financing, The Role of the Sponsor and many more topics.

For more information about Opal Group SPAC Opportunities Forum 2021, visit

https://www.opalgroup.net/trk/spacc2102.html

Contact:

Angélica Angulo

Marketing Assistant

No spam, notifications only about new products, updates.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

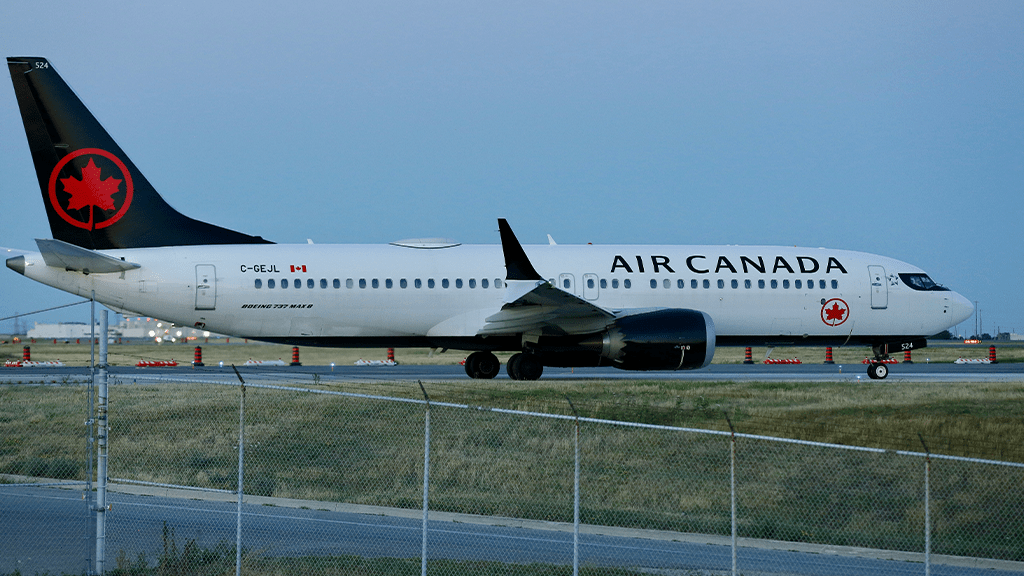

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.