Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

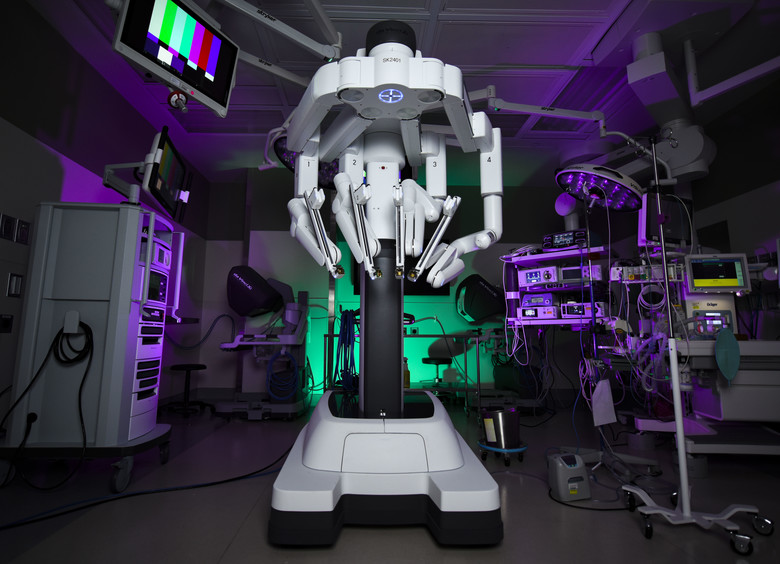

July 17, 2020: The Boston based startup is a pioneer in advanced technology for the Healthcare Industry. Every healthcare professional cannot expertise in everything they do at work. The experts or the top surgeon cannot be there in every hospital but, their thoughts and insights can be accessed to the normal surgeon through surgical-intelligence empowering scopes and robots from Activ surgery. Active Surgical has raised a $15 million round of venture funding led by ARTIS Ventures, and including participation from LRVHealth, DNS Capital, GreatPoint Ventures, Tao Capital Partners, and Rising Tide VC. The software platform launched early May and, the company sees a bright future with the advanced software platform. The data is collected through the sensor’s real-time during the surgery and is further transferred to the AI designed software.

The collected data used as a resource during any similar surgery and, the software provides updated information and guidance to perform surgery with no error.

The company launched the ActivEdge platform, which is a small imaging solution that can be attached to existing laparoscopic and arthroscopic instruments. The company is currently working with 8-hospitals in the United States as the pilot project. $32 million funds raised by the company to date.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.