Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

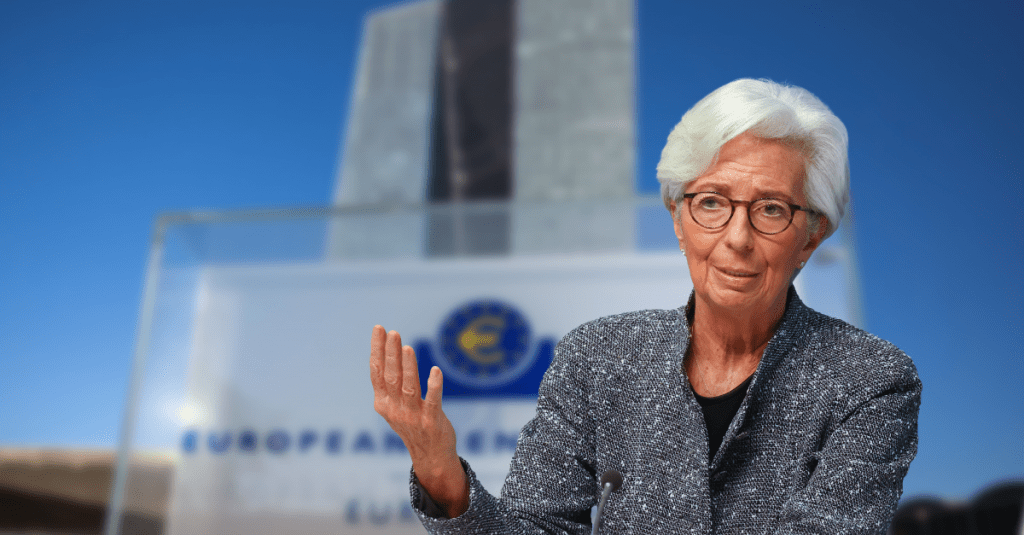

March 11, 2022: -This week, the European Central Bank is set for a cautious approach with its monetary policy meeting as Russia’s invasion of Ukraine impacts and potentially derails many of the policy plans it had for the rest of the year.

On Thursday, the meeting ends exactly two weeks after President Vladimir Putin initiated the unprovoked attack on Russia’s neighbor. The financial world has changed. Oil and gas prices have surged, and European Central Bank shares have lost all and more of their last year’s gains.

In a nutshell, the situation is highly unpredictable. But one thing is sure, inflation will be pushed even higher, and supply issues and high commodity prices will impact growth.

Against this backdrop, the ECB is set to stay put and opt for a wait-and-see approach.

“Energy prices and inflation will be pushed higher, while growth will weaken,” said Dirk Schumacher, an ECB watcher with Natixis, in a recent research note to clients.

“As it remains uncertain at this stage how increased this ‘stagflationary’ shock will turn out to be, expected the ECB to opt for a wait and see stance at the March meeting.”

An economy is going through stagflation experiences stagnant activity and accelerating inflation. This phenomenon was first recognized in the 1970s when an oil shock led to an extended period of higher prices but sharply falling GDP growth.

Inflation in the Eurozone was 5.1% in January and climbed to 5.8% in February as energy prices soared with the severe military escalation from Russia. The inflation development is getting worse as gas prices spike to historical highs, and Putin threatens to stop gas supplies altogether to answer the Western sanctions imposed on Moscow.

“The ECB still has one major advantage over the U.S. Fed. The worsening inflation overshoot in the Eurozone is caused solely by external shocks to supply and not by any factor the ECB could control,” said Holger Schmieding, chief economist with Berenberg, in a note.

“As a result, ECB council members affording to agree to delay some of the major decisions until the outlook has become clearer.”

The jury is still out on the war’s economic impact on the Eurozone. Still, there are early signs that supply chain issues will be aggravated, weighing even more on production, especially manufacturing.

Regarding higher interest rates, most economists polled by Reuters only see the first hike in the last few months of this year. However, there is no consensus on the month that the ECB could end its Asset Purchase Programme or APP.

“Optionality” will likely be the buzzword at the ECB press conference on Thursday afternoon as there’s a substantial lack of clarity in these most uncertain times.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings