Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

November 18, 2021: -The European Central Bank is warning valuations in many asset markets as the region continues to recover from the pandemic on the back of ultra-low interest rates and huge stimulus measures.

On Wednesday, in its biannual stability report, the euro zone’s central bank mentioned vulnerabilities in property and financial markets, which added that “risk-taking by non-banks and elevated sovereign and corporate debt is building up.”

On property, it says that risks of price corrections over the medium term had increased substantially between rising estimates of house price overvaluations.

“In particular, households with variable rate mortgages or shorter fixed-rate periods on their mortgages are exposed to an unexpected increase in interest rates, that adversely affects their ability to service their debt,” the report said.

Luis de Guindos, the vice president of the ECB, is surged a “striking buoyancy” for equity and risky asset markets, “which makes them more susceptible to corrections.”

“There have been examples of established market players exploring more novel and more exotic investments. In parallel, euro area housing markets have expanded rapidly, with little indication that lending standards are tightening in response,” he said.

Speaking to CNBC, de Guindos said near-term risks were declining, but there were rising vulnerabilities for the medium term.

He insisted that inflation for the region should still be seen as “largely transitory.”

“They are going to start to fade out over the next months,” he told CNBC.

“I think that perhaps we reach a peak in terms of inflation in November, and afterward, we project that inflation will start to slow down.”

In September, the central bank announced it would be buying fewer bonds off the back of surging consumer prices. This began the process of slowly winding down its substantial pandemic-era stimulus package.

Inflation in the eurozone hit 3.4% in September, representing a 13-year high. In October, inflation then hit another 13-year high at 4.1%, as the currency bloc battled surging energy costs.

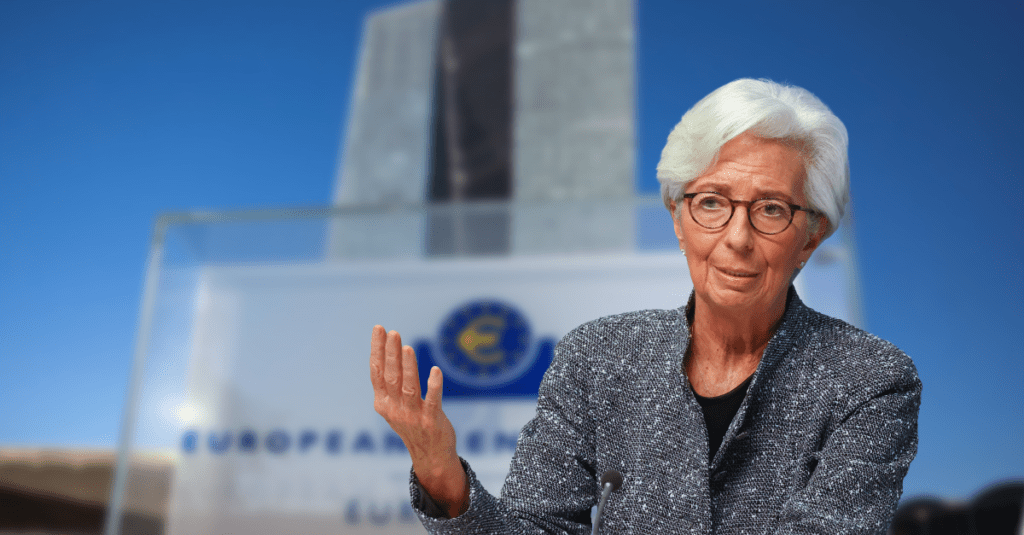

In September, ECB President Christine Lagarde made it clear that the central bank’s actions were a recalibration but not a tapering. This is because the ECB believes that higher inflation is temporary and will fade throughout 2022.

Some market participants believe the ECB underestimates inflationary pressures and will, therefore, likely have to announce a rate hike before 2023. Indeed, money markets have priced in the probability of a 20-basis point hike for December 2022.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings