Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

MONROE, La., Jan. 24, 2020 CenturyLink, Inc. (NYSE: CTL) announced that it completed its previously-announced sale of $1.25 billion aggregate principal amount of newly-issued 4.000% Senior Secured Notes due 2027 (the “2027 Notes”).

CenturyLink used the net proceeds from the offering to repay a portion of the indebtedness under its existing 2017 senior secured credit facilities.

The 2027 Notes are unconditionally guaranteed by each of CenturyLink’s domestic subsidiaries that guarantees CenturyLink’s 2017 senior secured credit facilities, subject to the receipt of certain regulatory approvals and various exceptions and limitations. While the 2027 Notes will not be secured by any of the assets of CenturyLink, the guarantees will be secured by a first priority security interest in substantially all of the assets of certain guarantors, which assets also secure obligations under CenturyLink’s 2017 senior secured credit facilities on a pari passu basis.

The 2027 Notes were privately placed without being registered under the Securities Act of 1933, as amended.

About CenturyLink

CenturyLink (NYSE: CTL) is a technology leader delivering hybrid networking, cloud connectivity, and security solutions to customers around the world. Through its extensive global fiber network, CenturyLink provides secure and reliable services to meet the growing digital demands of businesses and consumers. CenturyLink strives to be the trusted connection to the networked world and is focused on delivering technology that enhances the customer experience.

Forward Looking Statements

Except for historical and factual information, the matters set forth in this release and other of our oral or written statements identified by words such as “estimates,” “expects,” “anticipates,” “believes,” “plans,” “intends,” “will,” and similar expressions are forward-looking statements. These forward-looking statements are not guarantees of future results and are based on current expectations only, are inherently speculative, and are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control. Actual events and results may differ materially from those anticipated, estimated, projected or implied by us in those statements if one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect. You are cautioned not to unduly rely upon our forward-looking statements, which speak only as of the date made. We undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise. Furthermore, any information about our intentions contained in any of our forward-looking statements reflects our intentions as of the date of such forward-looking statement, and is based upon, among other things, existing regulatory, technological, industry, competitive, economic and market conditions, and our assumptions as of such date. We may change our intentions, strategies or plans (including our plans expressed herein) without notice at any time and for any reason.

SOURCE CenturyLink, Inc. https://www.prnewswire.com/news-releases/centurylink-completes-private-offering-of-senior-secured-notes-300992967.html

No spam, notifications only about new products, updates.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

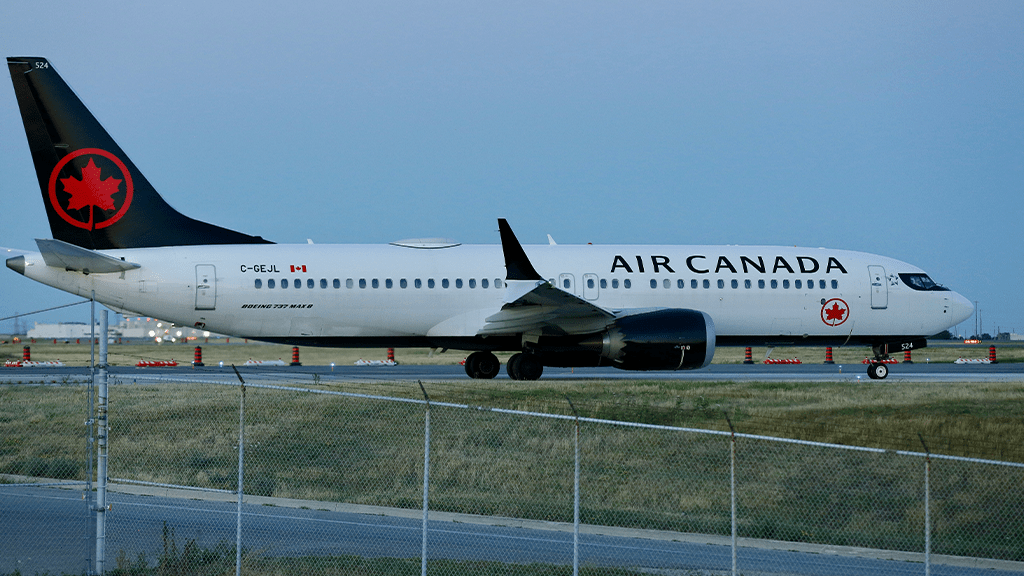

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.