- June 30, 2025 3:22 pm

- California

An article by Erik Swain for MDDI describes the journey of Boston Scientific in the last 25 years. The year is 1979. The medical device industry is worth $10.3 billion and has only one company, Medtronic Inc., of any significant size. U.S. medical device regulations have been codified for only three years, and FDA is still figuring out how to implement them. The first magazine covering device manufacturing, MD&DI, has just begun publication. Boston Scientific Corp. was founded in this uncertain, diversified, decentralized environment. The new company, a consolidation of several small medical device firms whose history dates back to 1965, starts with sales of $2 million in its first year. The much larger pharmaceutical industry has only begun to become interested in the device sector.

The year is 2004. The medical device industry is worth $93.8 billion and includes several billion-dollar companies. Strict FDA regulations hold sway over the industry. MD&DI is in its 25th year of publication and has grown its coverage following the increasingly complex medical device sector. Small firms remain the source of much of the industry’s innovation, but large firms are the ones that make the most headlines and attract the most interest from the financial markets. One of those behemoths is the 25-year-old Boston Scientific, which had sales of $3.5 billion in 2003 and is expected to exceed that in 2004. Behind the success is the company’s U.S. launch of its Taxus drug-eluting stent, a revolutionary technology that is radically changing the cardiovascular field. It represents the wave of the future—drug-device combination products.

The dramatic growth and diversification of the Natick, MA–based company parallels that of the industry. While the growth curves aren’t an exact congruence— sometimes Boston Scientific was ahead of the trends, other times it was unaffected by them—in many cases, the forces that allowed the company to advance also propelled the entire industry’s progress. Like MD&DI, the growth of Boston Scientific also tells the story of the past 25 years in the device industry.

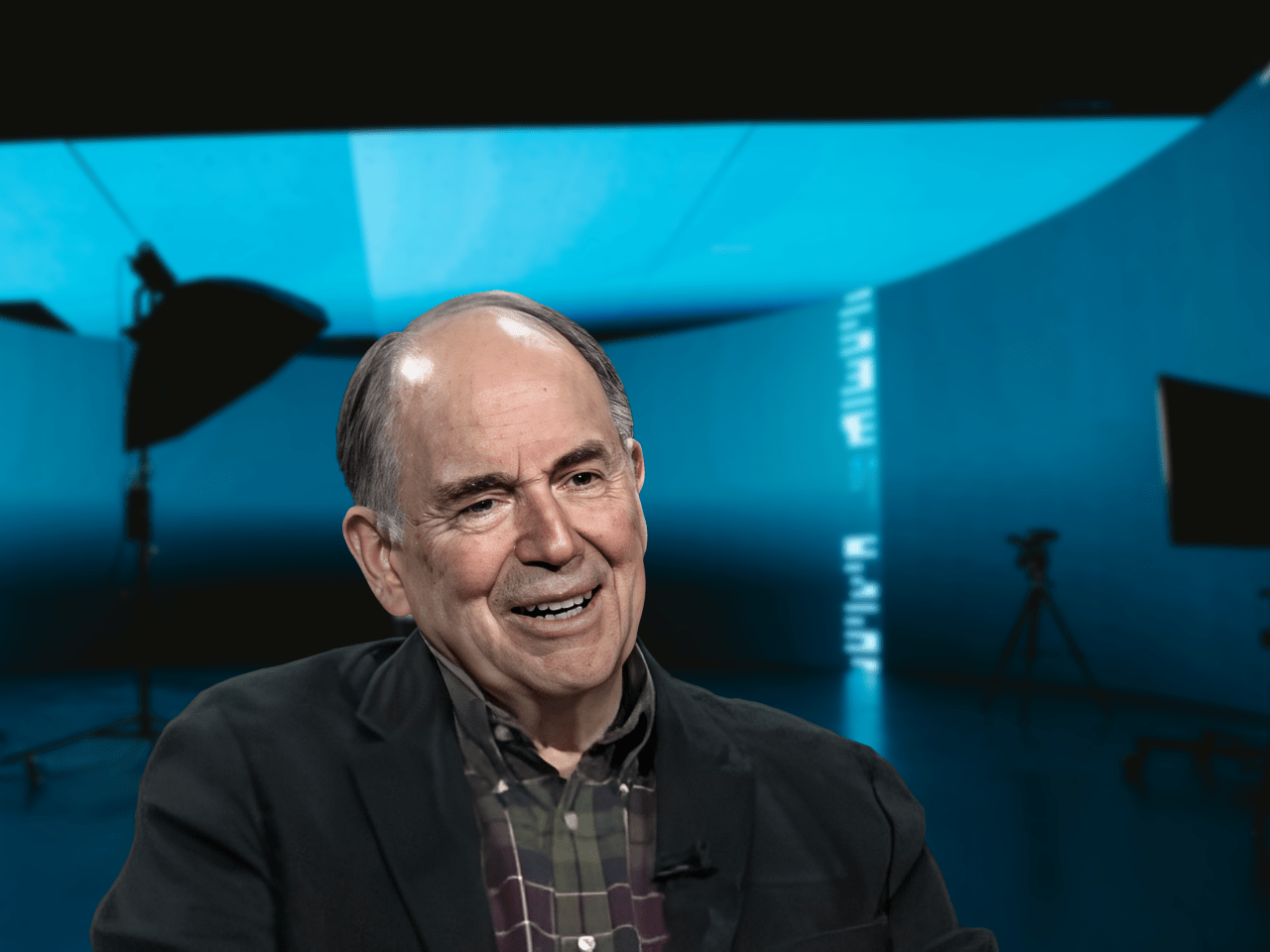

Boston Scientific’s chief predecessor company, Medi-tech, pioneered developing the steerable and balloon catheter. These days, venture capitalists and large device companies would be champing to invest in such a firm. But that was not the case in 1979. Instead, John E. Abele, Co-Founder and Director Emeritus at Boston Scientific Corporation and a minority shareholder of Medi-tech, teamed up with Peter Nicholas, who had run the medical products division of Millipore Corp., to form Boston Scientific and buy the outstanding shares of Medi-tech. Nicholas became chairman and CEO and still holds the former position today, and Abele served as co-chairman.

“The financial markets hadn’t recognized the device industry as having much value,” Abele said. “So financing was a bit tricky, and a lot of the companies were inventor-founded and -led.” One reason for the industry’s low profile was that it was not seen as a force that helped shape the healthcare landscape. Instead, its marketing approach consisted almost entirely of reacting to what physicians wanted. Through Abele’s and Nicholas’ efforts, Boston Scientific was one of the first device companies to market aggressively. It was not an easy transition.

“The industry philosophy was, ‘Tell us what you want, and we’ll build it for you,’” Abele said. The device industry relied on physicians to provide all the criteria, and Boston Scientific had a slightly different idea. “We felt that there was an opportunity to get more involved.”

“The idea of somebody from business giving a presentation at a medical school, even if it were technical, was heretical,” Abele said. “But good relationships, objective noncommercial presentations, and interest in the novel and disruptive technology we had developed carried the day.” Another factor was that Nicholas created separate business units to focus on different device markets, enabling a more effective sales strategy. While common today, this structure was rare at the time.

Boston Scientific was one company that needed help adapting to that climate. “We used to go four to five years without a major new product in device-land because we could,” said Tom Gunderson, a senior research analyst for Piper Jaffray (Minneapolis), covering Boston Scientific since it went public. “But then there came the imperative to get newer and better products out as fast as you can. Boston Scientific was way beyond everyone else from a speed standpoint in those days. They had a high-level vice president who was in charge of ensuring product innovation went as fast as possible. They were strong in the market development side as well, and they were good at taking over technology and improving it.”

The most significant was the purchase of Scimed Life Systems Inc., another pioneer in angioplasty and other cardiovascular technologies. This sealed Boston Scientific’s status as an essential player in the most lucrative device field, cardiology. “That was not just for size but for strategic mass,” said Abele.

The Boom Years

Suddenly, the device industry was growing companies of substantial size and attracting tremendous interest from Wall Street. But, as markets go up, they also come down. A string of disastrous initial public offerings in 1995 and 1996 put the device industry out of favor on Wall Street, and the frenzy over tech stocks ensured it stayed that way for a few years. With the notable exception of Johnson & Johnson, the pharmaceutical companies that had bought up device companies a few years before began to sell them off. Boston Scientific had amassed significant debt from its acquisition spree, and some industry observers became concerned about whether the firm would collapse under its weight. In the mid-and late 1990s, its stock often struggled because of those concerns. In 1997, MD&DI reported that in a survey of 130 medical device company CEOs, “66% felt that medical device and diagnostic company initial public offerings issued during 1995 and 1996 were overvalued.”

But a collapse did not happen to Boston Scientific for several reasons that have become indicators of success throughout the entire device industry. One was that its acquisitions were, for the most part, integrated smoothly and made profitable quickly. Abele estimates an 80% success rate, whereas the norm for the device industry is less than 50%. “We are a multi-billion-dollar company, but we are still entrepreneurial,” he said, adding that the company still forms relationships with smaller companies. Their smaller partners value these relationships as well, he said. “We are certainly not perfect, but a lot of owners of companies we’ve purchased will tell you they’ve had a good experience with us,” which he said is not commonly heard.

Another reason the firm avoided failure was that it always retained its commitment to a long-term growth strategy. Management spent much time analyzing areas in which fast growth and strong product development would occur. “We would look forward not just to see where we would continue to grow but to plan a strategy for growth in areas that we weren’t even involved in yet,” Abele said. “For example, we amassed a portfolio of patents in gene therapy beginning more than 10 years ago. We acquired Target Therapeutics (in 1997) to get a foothold in the neurology business.” By the mid-1990s, it became clear that not all device sectors were created equal, and a strong presence in fast-growing, Wall Street–hyped areas like cardiology and neurology was necessary to become an industry giant. Another positive factor was that after Kessler’s departure, FDA became more interested in communication and collaboration with the industry, prioritizing faster review times and enabling innovative products to come to market more quickly.

“They were able to grow their way out of debt,” said Lars Enstrom, a director for investment bank Houlihan Lokey Howard & Zukin (Los Angeles). “And that was because they were in high-growth areas. They made very good acquisitions and established growth platforms. If they saw something they felt they needed to have, they went out and got it.”

As many device firms do when they reach a specific size, in 1999, Boston Scientific brought in a CEO from the outside. Jim Tobin had run Baxter International and then Biogen Inc., and he knew a few things about streamlining a large organization.

“He is an experienced, aggressive manager who moved quickly to consolidate a lot of their businesses and make them more efficient,” said Blank. “Nicholas is a visionary who bought a lot of successful companies and helped accelerate the pace of technology we’ve seen. Tobin’s team is more operations oriented. They are building size and might strategically, which is not easy to do.”

Around that time, device firms started to rely more on contract manufacturers to produce their products. It was part of an industry-wide trend to focus on what the firm did best and then outsource as much of the rest as possible. Boston Scientific may not have been the first to rely heavily on these contractors, but it was ahead of the curve and was one of the most creative in making those arrangements.

“They were looking for unique ways to improve productivity and efficiency,” said J. Randall Keene, CEO of Avail Medical Products (Fort Worth, TX). “They were looking for more than a vendor. They were looking for a partner. Tobin encouraged everyone to think outside the box. The pace and demand for these new products and the speed with which they get produced are significantly enhanced today.”

In the 21st century, much of the enthusiasm about the industry centers on drug-device combination products. In recent years MD&DI had begun covering them extensively, especially after April 2003, when J&J received the first FDA approval for a drug-eluting stent. Boston Scientific has been a significant player, too, with its Taxus drug-eluting stent having the potential to become the biggest-selling device in industry history. But as with many breakthroughs in the device industry, this one was years in the making and took a lot of foresight and planning. “The irony is that we saw the potential of drug-device combination products in the 1970s, first in the embolization field, which could use a physical or biological approach,” Abele said. “From there, we saw that it was necessary to help the body help itself.” Indeed, some believe that the technology for drug-eluting stents was there in the 1990s and was held back only because firms couldn’t perfect the necessary coatings.

Intellectual property (IP) played a significant role as well. Boston Scientific made real headway with its IP only after acquiring Scimed in 1995 and Schneider Worldwide in 1998. The latter had been owned by drug giant Pfizer and had defeated Boston Scientific in court over a rapid-exchange angioplasty technology. When Pfizer decided to exit the device business, Boston Scientific, which still craved that patent, snapped up Schneider for $2.1 billion, virtually unheard of in the device industry then. Resources from all three companies proved crucial in developing Taxus, and Schneider’s polymer technology may have been the most critical piece of the puzzle.

Taxus is now on pace to become that rarest of medical products—the billion-dollar device. The acquisition is still the core growth strategy, as evidenced by the recent $750 million purchase of Advanced Bionics Corp., which is expected to make the company a leader in the field of neurostimulators. With the drug and device markets converging and new ways of thinking about how to repair the body coming into vogue, firms with the resources to develop blockbuster products and the smarts to sense the following significant innovations will lead the device industry through its next 25 years. It would surprise no one if Boston Scientific continued to evolve, ensuring it remains one of those leaders.

" We would look forward not just to see where we would continue to grow but to plan a strategy for growth in areas that we weren’t even involved in yet. "

John E. Abele

Co-Founder & Director Emeritus