Boost Your Productivity and Profits: The Accounting Software You’ve Been Waiting For!

Once upon a time, a group of entrepreneurs found themselves tangled in a web of financial complexities in the bustling kingdom of …

The Federal Reserve’s Atlanta branch president, Raphael Bostic, has suggested that the central bank may not need to wait for inflation to return to its 2% target before considering a reduction in interest rates. Bostic’s comments come as the U.S. economy faces a delicate balancing act between managing inflation and maintaining a healthy labor market.

Bostic emphasized that the Federal Reserve must prioritize price stability and maximum employment. While inflation has gradually declined, he expressed concerns that waiting too long to ease monetary policy could negatively impact the job market. By implementing a rate cut sooner, the Fed could mitigate the risk of unnecessary economic hardship.

The recent economic data has provided mixed signals. While inflation has shown signs of moderation, the labor market remains relatively strong. This challenges the Fed, which must carefully assess the risks and benefits of adjusting interest rates.

Bostic’s remarks align with the growing expectations among economists and investors that the Federal Reserve will begin to lower interest rates in the coming months. However, the timing and magnitude of any rate cuts will depend on the evolving economic landscape.

The Federal Reserve’s decision on interest rates will have significant implications for the broader economy. A rate cut could stimulate economic growth and raise concerns about potential inflationary pressures. The central bank will need to carefully weigh these factors and make a decision that best serves the interests of the U.S. economy.

Once upon a time, a group of entrepreneurs found themselves tangled in a web of financial complexities in the bustling kingdom of …

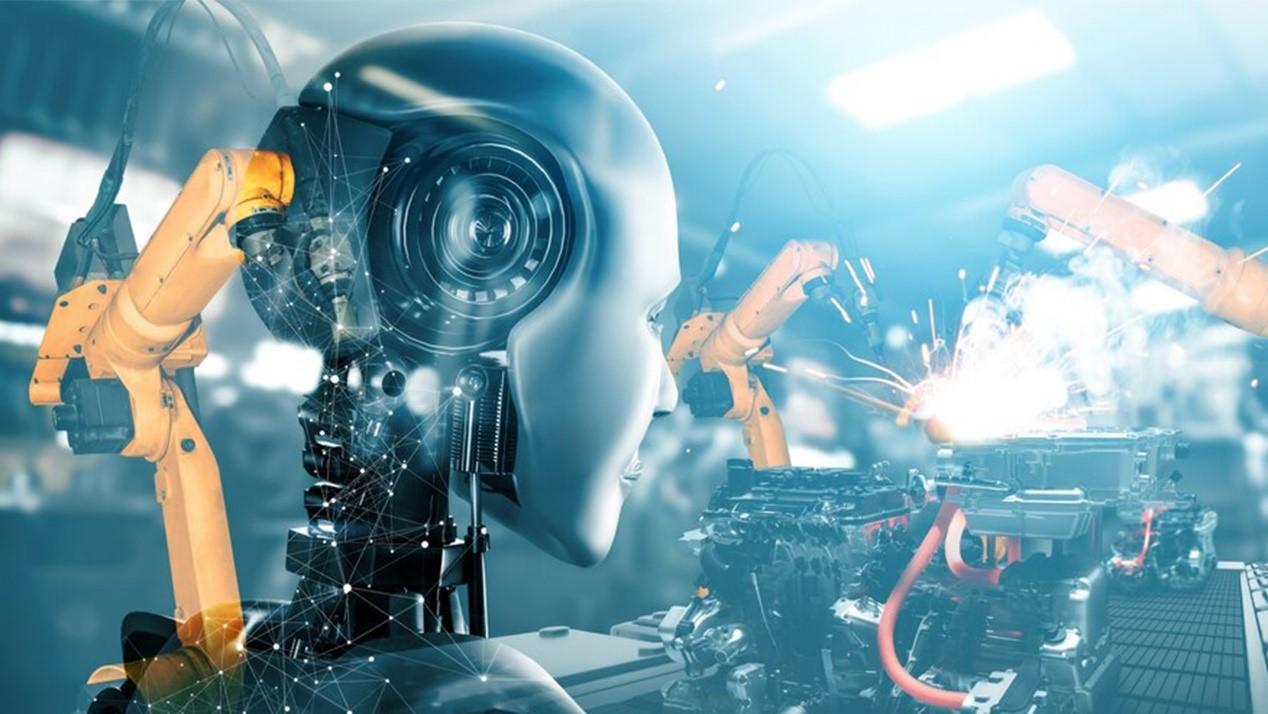

A profound revolution is underway in the labyrinth of time, where the threads of innovation and industry intertwine. Modern factories, akin to …

A new study indicates that including social determinants of health in sepsis readmission models could …

In the annals of human history, the art of manufacturing has undergone a metamorphosis so profound that it has reshaped …