- February 15, 2026 10:52 am

- California

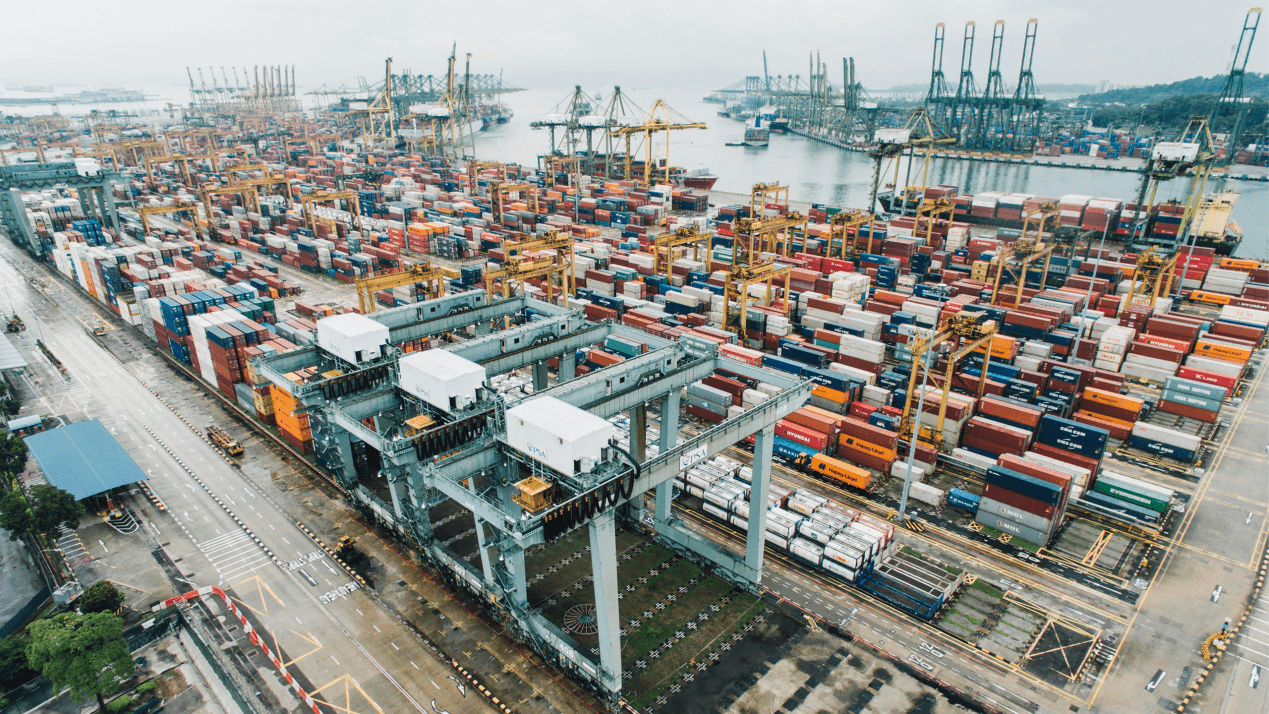

The ongoing strike at West Coast ports has the potential to reignite inflationary pressures, with the severity of the economic impact contingent upon the duration of the labor dispute. The disruption to supply chains and increased transportation costs could lead to higher prices for consumers and businesses.

The strike, which began in late July, has resulted in significant delays in the movement of goods through major West Coast ports. This disruption has created bottlenecks in the supply chain, leading to shortages of certain products and driving up prices.

Economists are concerned that the prolonged strike could exacerbate inflationary pressures, which have been a significant concern in recent months. Supply chain disruptions and increased demand for goods have contributed to rising prices for a wide range of products, including food, energy, and consumer goods.

If the strike continues for an extended period, the economic impact could be more severe. Businesses may be forced to pay higher consumer costs, leading to further inflationary pressures. Additionally, the disruption to supply chains could impact economic growth and job creation.

The outcome of the labor negotiations will be closely watched by businesses, consumers, and policymakers alike. A swift resolution to the strike is essential to minimize the economic damage and prevent further inflationary pressures.

While the full extent of the port strike’s economic impact remains uncertain, the disruption to supply chains and the potential for higher prices pose significant risks to the economy. A prolonged strike could have a lasting impact on inflation and economic growth.

It is imperative that the parties involved in the negotiations work toward a resolution that addresses the concerns of both workers and employers. A fair and equitable settlement is essential to ensure the smooth functioning of the economy and protect consumers from the negative consequences of inflation.