Canada Appeals for International Firefighting Aid

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

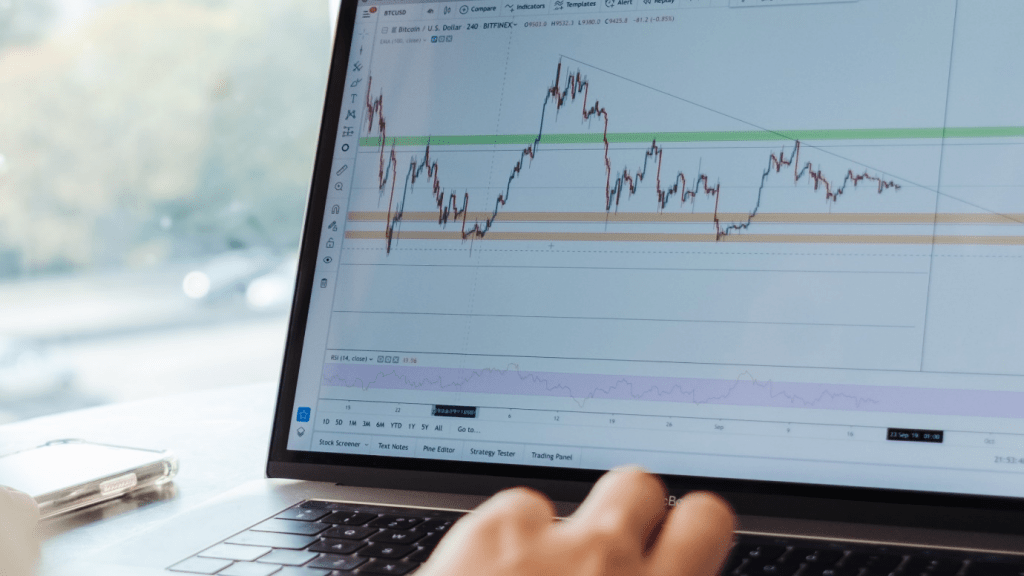

June 23, 2022: -On Wednesday, U.S. stock index futures decreased after the major averages increased during normal trading hours, which attempts to claw back some losses after weeks of selling.

Futures contracts tied to the Dow Jones Industrial Average decreased 343 points or 1.1%, while S&P 500 futures declined 1.3%. Nasdaq 100 lots reached down to 1.6%.

On Tuesday, the Dow ascended 641 points or 2.15%. The S&P 500 added 2.45%, turning in its best day since May 4. The jump comes after the benchmark index declined 5.79% during the final week in its worst weekly performance since March 2020.

On Tuesday, the Nasdaq Composite advanced 2.51% after its tenth week of losses in the previous 11 weeks.

Growing fears that the economy will tip into a recession contain recently weighed on stocks. The Federal Reserve in the previous week hiked interest rates by three-quarters of a percentage point, the central bank’s most significant rate increase since 1994.

The move came as the Fed tried to cool inflation, which has increased to a 40-year high.

“We don’t see the U.S. or global slump in ’22 or ’23 in our base case, but it’s clear that the risks of a hard landing are growing,” UBS said Tuesday in a note to clients.

“Even if the economy does slip into a slump, regardless, it should be a shallow one given the power of consumer and bank balance sheets,” the firm added.

Goldman Sachs, meantime, believes a recession is becoming increasingly likely for the U.S. economy, saying that the risks of a recession are “higher and more front-loaded.”

“The main reasons are that our baseline growth path is now lower and that we are increasingly concerned that the Fed will feel forced to respond forcefully to high headline inflation and consumer inflation expectations if energy prices rise additionally, even if activity slows sharply,” the firm said in a note to clients.

Tuesday’s rally begs whether the action is short-term relief after weeks of selling or a significant change in sentiment. On Tuesday, the strength was broad-based. All 11 S&P sectors registered gains on the day, with energy leading the way, growing 5.8%.

“Our expectations are that market volatility will presumably persist near term until the actions taken by the Federal Reserve thus far, and the actions it takes going along have had time to function through the system,” Oppenheimer said Tuesday in a note to clients.

We provide the insights on leaders who are responsible for taking their organization to new heights, all the while bringing together a group of talented individuals.

June 09, 2025: Canada has issued an international appeal for firefighting support as wildfires intensify across multiple provinces

May 27, 2025: Air Canada Cuts Five U.S. Routes for Winter 2025–26, Part of Broader Cross-Border Retrenchment

May 26, 2025: Trump Freezes $2.2B in Federal Grants to Harvard Over DEI, Threatens Tax-Exempt Status.

May 14, 2025: Microsoft has announced plans to reduce its global workforce by approximately 3%, affecting roughly 10,000 employees across multiple departments.

May 13, 2025: The Trump administration is considering suspending the constitutional right of habeas corpus in a bid to accelerate mass deportations.

April 29, 2025: Donald Trump’s second term has reached the 100-day mark under sustained public skepticism, with national approval ratings